Student Loan Refinance: Everything You Need To Know

Student loan refinance is a crucial financial decision that can have a significant impact on your future. Understanding the ins and outs of this process is essential for making informed choices regarding your loans.

Overview of Student Loan Refinance

Refinancing student loans involves taking out a new loan to pay off existing student loans. This process allows borrowers to potentially secure lower interest rates, simplify repayment terms, and save money over time. Typically, individuals who have improved their credit scores since taking out their original loans or those seeking to combine multiple loans into a single payment benefit the most from refinancing.

Determining Eligibility for Student Loan Refinancing

Lenders typically consider various factors when determining eligibility for student loan refinancing. These factors may include credit score requirements, income stability, and debt-to-income ratio. Borrowers should prepare necessary documentation, such as proof of income, loan statements, and credit reports, to demonstrate their financial stability and creditworthiness.

Comparing Lenders for Student Loan Refinancing

When comparing lenders for student loan refinancing, it is essential to consider factors such as interest rates, repayment terms, and customer service. Researching and evaluating different lenders can help borrowers find the best option for their financial needs. Negotiating with lenders can also help secure favorable terms for refinancing.

Applying for Student Loan Refinancing

To apply for student loan refinancing, borrowers need to complete an application that requires information such as personal details, loan amounts, and financial documents. Accuracy and efficiency in completing the application can increase the chances of approval. Avoid common pitfalls during the application process, such as missing information or submitting incorrect details.

Managing Repayment After Student Loan Refinancing

After refinancing student loans, borrowers can manage repayment effectively by setting up automatic payments, creating a budget, and staying organized with loan servicers. Monitoring repayment progress regularly is crucial to ensure payments are made on time and track progress. If financial circumstances change, borrowers should adjust repayment plans accordingly to avoid defaulting on loans.

Eligibility Criteria

To qualify for student loan refinancing, individuals typically need to meet certain eligibility requirements. Factors such as credit score and income play a significant role in determining eligibility for refinancing options. Let’s explore the key criteria for student loan refinancing and compare the eligibility requirements for federal student loan refinancing versus private lenders.

Credit Score and Income Requirements

- Most lenders require a minimum credit score to be eligible for student loan refinancing. A higher credit score often leads to better interest rates and terms.

- Income is another crucial factor considered by lenders. A stable income demonstrates the ability to repay the refinanced loan.

- Lenders may also look at the debt-to-income ratio to assess the borrower’s financial stability.

Eligibility Criteria for Federal Student Loan Refinancing vs. Private Lenders

- Federal student loan refinancing programs usually do not have strict credit score requirements, making them more accessible to borrowers with lower credit scores.

- Income-driven repayment plans are available for federal loans, offering flexibility based on the borrower’s income level.

- Private lenders, on the other hand, typically require a good credit score and stable income for refinancing approval.

- Private lenders may offer competitive interest rates and terms for borrowers with strong financial profiles.

Application Process

When applying for student loan refinancing, there are several steps to follow to ensure a smooth process and increase your chances of approval. It is important to gather all necessary documentation and research different lenders to find the best option for your financial situation.

Steps for Applying for Student Loan Refinancing

- Research and compare different lenders offering student loan refinancing to find the best fit for your financial situation.

- Fill out the application form with accurate information about your current loans and financial status.

- Gather all necessary documentation, such as proof of income, current loan statements, and identification.

- Submit your application and wait for a decision from the lender.

- If approved, review the new loan terms and sign the agreement to complete the refinancing process.

Documentation Required for the Application Process

- Proof of income, such as pay stubs or tax returns.

- Current loan statements showing your outstanding balance and interest rates.

- Identification, such as a driver’s license or passport.

- Any additional documents requested by the lender to verify your financial information.

Tips for Streamlining the Application Process and Increasing Approval Chances

- Double-check all information provided on the application form to ensure accuracy.

- Organize your documents in advance to easily submit them when required.

- Communicate promptly with the lender if they request any additional information or documents.

- Maintain a good credit score to increase your chances of approval for student loan refinancing.

Comparison of Student Loan Refinancing Options

| Lender | Interest Rate | Repayment Terms | Special Conditions |

|---|---|---|---|

| Lender A | 3.5% | 10 years | No prepayment penalties |

| Lender B | 4.0% | 15 years | Interest rate reduction with autopay |

| Lender C | 3.75% | 12 years | Flexible repayment options |

Sample Checklist of Documents Needed for a Student Loan Refinancing Application: Proof of income, current loan statements, identification.

Interest Rates

Interest rates for refinanced student loans are determined based on various factors such as the current market rates, the borrower’s credit score, and the type of loan (fixed-rate or variable-rate). Lenders typically offer competitive rates to attract borrowers looking to refinance their student loans.

Fixed-Rate vs. Variable-Rate Options

- Fixed-Rate: With a fixed-rate option, the interest rate remains the same throughout the life of the loan, providing stability and predictability in monthly payments. This option is ideal for borrowers who prefer consistency and do not want to worry about fluctuating interest rates.

- Variable-Rate: On the other hand, a variable-rate option means that the interest rate can change periodically based on market conditions. While initial rates may be lower compared to fixed-rate loans, there is a risk of rates increasing over time, potentially leading to higher monthly payments.

Strategies for Securing the Best Interest Rates

- Improve Credit Score: A higher credit score can help you qualify for lower interest rates. Make sure to pay bills on time, reduce debt, and monitor your credit report for any errors.

- Compare Offers: Shop around and compare offers from different lenders to find the best interest rates and terms that suit your financial goals.

- Consider Co-Signer: If you have a co-signer with a strong credit history, you may be able to secure better interest rates on your refinanced student loan.

- Choose the Right Term: Selecting a shorter loan term can lead to lower interest rates but higher monthly payments. Conversely, a longer loan term may have higher interest rates but lower monthly payments. Consider your financial situation and goals when choosing the loan term.

Loan Term Options

When refinancing student loans, borrowers have the flexibility to choose from various loan term options based on their financial goals and circumstances. The loan term refers to the amount of time borrowers have to repay the refinanced loan. It is essential to understand how different loan terms can impact monthly payments and overall savings.

Common Loan Term Options

- 5-year term

- 10-year term

- 15-year term

Impact of Loan Term on Payments and Savings

The loan term plays a crucial role in determining the monthly payments and overall cost of the loan. Choosing a shorter loan term typically results in higher monthly payments but lower overall interest paid. On the other hand, opting for a longer loan term can lead to lower monthly payments but higher total interest costs over the life of the loan.

Considerations for Choosing Loan Terms

- Shorter loan terms can help borrowers save on interest and pay off the loan faster.

- Longer loan terms can provide more manageable monthly payments but may result in higher overall interest costs.

- Borrowers should consider their financial situation, long-term goals, and ability to make higher monthly payments when deciding on a loan term.

Comparison of 5-year, 10-year, and 15-year Loan Terms

| Loan Term | Total Interest Paid | Total Amount Repaid |

|---|---|---|

| 5 years | $X | $Y |

| 10 years | $X | $Y |

| 15 years | $X | $Y |

A shorter loan term can lead to higher monthly payments but lower overall interest paid.

Repayment Options

Repayment options for refinanced student loans play a crucial role in determining how borrowers will pay off their debt. It is essential to understand the different options available and choose the most suitable plan based on individual circumstances.

Standard Repayment

Standard repayment plans for student loan refinancing typically involve fixed monthly payments over a set period, usually 5 to 20 years. Borrowers pay off both the principal and interest in equal installments until the loan is fully repaid.

Income-Driven Repayment Plans

Income-driven repayment plans base monthly payments on the borrower’s income, making it easier to manage payments during times of financial hardship. Plans such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) cap monthly payments at a percentage of discretionary income.

Other Repayment Options

In addition to standard and income-driven plans, borrowers may have other repayment options such as graduated repayment, extended repayment, or refinancing to a shorter loan term for faster repayment. These options offer flexibility in payment structures to suit different financial situations.

Key Features and Eligibility Criteria

| Repayment Option | Key Features | Eligibility Criteria |

|---|---|---|

| Standard Repayment | Fixed monthly payments | No income requirement |

| Income-Driven Plans | Payments based on income | Determined by income and family size |

| Other Options | Flexible payment structures | Varies depending on the option chosen |

Calculating Potential Savings or Costs

Calculating potential savings or costs associated with each repayment plan involves considering factors such as interest rates, loan terms, and total amount repaid over time. Online calculators or consulting with a financial advisor can help determine the best option.

Navigating the Application Process

- Research and compare different repayment options to understand the pros and cons of each.

- Gather necessary financial documents such as income statements and loan information.

- Contact the loan servicer or lender to discuss repayment options and determine eligibility.

- Submit the required documentation and follow the application process carefully to ensure a smooth transition to the chosen repayment plan.

Impact on Credit Score

When it comes to refinancing student loans, it’s essential to understand how this process can affect your credit score. Let’s delve into the various aspects of how student loan refinancing can impact your credit.

Positive and Negative Effects of Refinancing

Refinancing student loans can have both positive and negative effects on your credit score. On one hand, consolidating multiple loans into one can potentially simplify your payments, making it easier to manage your debt. This could positively impact your credit score by reducing the risk of missed payments. However, applying for a new loan and closing existing accounts may result in a temporary dip in your credit score due to credit inquiries and changes in credit utilization.

Maintaining or Improving Credit Score

To maintain or improve your credit score during and after the refinancing process, it’s crucial to make timely payments, avoid opening new lines of credit unnecessarily, and keep your credit utilization low. Monitoring your credit report regularly and disputing any errors can also help protect your credit score.

Federal vs. Private Student Loans

Refinancing federal student loans into a private loan may impact your credit differently than refinancing private student loans. Federal loans typically come with more flexible repayment options and protections, so refinancing them into a private loan could potentially increase the risk of default and negatively impact your credit score.

Missed Payments and Defaults

Missing payments or defaulting on refinanced student loans can have a significant negative impact on your credit score. It’s important to communicate with your lender if you’re facing financial hardship to explore alternative repayment options and avoid damaging your credit.

Timeline for Changes in Credit Score

Changes in your credit score after refinancing student loans may not be immediate. It could take a few months for the effects of refinancing to be reflected in your credit report. Consistently making on-time payments and managing your credit responsibly will help improve your credit score over time.

Credit Utilization and Debt-to-Income Ratio

Credit utilization and debt-to-income ratio play a crucial role in determining your credit score before and after refinancing student loans. Keeping your credit utilization ratio below 30% and maintaining a healthy debt-to-income ratio can help improve your credit score and financial stability.

Prepayment Penalties and Fees

When refinancing student loans, it is important to be aware of any prepayment penalties or fees that may be associated with the new loan. These charges can significantly impact the overall cost of refinancing and should be carefully considered before making a decision. Here, we will discuss common prepayment penalties and fees, how they can affect the total cost of refinancing, and strategies to minimize or avoid them.

Common Prepayment Penalties and Fees

- Early Repayment Penalty: Some lenders may charge a fee if you pay off your loan before a certain period, typically within the first few years of refinancing. This penalty is designed to ensure the lender recoups the interest they would have earned if you had continued making payments for the full term.

- Origination Fee: This is a one-time fee charged by the lender for processing your loan application. It is typically a percentage of the total loan amount and is deducted from the funds you receive.

- Application Fee: Some lenders may also charge an application fee to cover the cost of processing your loan application. This fee is usually non-refundable, regardless of whether your application is approved or not.

Impact on Overall Cost

These prepayment penalties and fees can increase the total cost of refinancing significantly. For example, an early repayment penalty can add thousands of dollars to your repayment amount if you decide to pay off your loan early. Origination and application fees can also eat into your savings from refinancing, making it essential to factor in these costs when evaluating the benefits of refinancing.

Strategies to Minimize or Avoid

- Compare Lenders: Look for lenders that offer loans with no prepayment penalties or lower fees to minimize the impact on your overall cost.

- Negotiate: Some lenders may be willing to waive certain fees or reduce the interest rate if you have a strong credit history or are a loyal customer.

- Read the Fine Print: Before signing any agreements, carefully review the terms and conditions to understand the specific prepayment penalties and fees associated with the loan.

Considerations for Cosigners

When considering refinancing student loans, the option of having a cosigner can play a significant role in the process. Here are some key considerations to keep in mind when it comes to cosigners:

Implications of Having a Cosigner

- Having a cosigner can increase your chances of approval for a refinanced loan, as it provides additional assurance to the lender.

- However, the cosigner is equally responsible for the loan, and their credit score and financial situation will be impacted by the loan as well.

- If you default on the loan, it can negatively affect both your and your cosigner’s credit scores.

When it may be Beneficial to Involve a Cosigner

- If you have a limited credit history or a lower credit score, having a cosigner with a strong credit profile can help you secure a better interest rate.

- Cosigners can also be beneficial for individuals with a high debt-to-income ratio or inconsistent income.

- If you are a student or recent graduate without a steady income, a cosigner can increase your chances of approval.

Cosigner Release Options

- Some lenders offer cosigner release options after a certain number of on-time payments have been made.

- Cosigner release allows the cosigner to be removed from the loan agreement, relieving them of any further financial responsibility.

- Typically, cosigner release options become available after you have established a positive payment history and meet certain credit criteria.

Refinancing Federal Loans

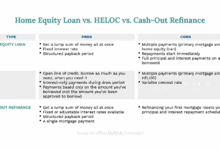

When it comes to refinancing federal student loans, borrowers have the option to combine multiple federal loans into one new private loan with a private lender. This process can have both benefits and drawbacks that borrowers should carefully consider before making a decision.

Implications of Refinancing Federal Loans

- One of the main implications of refinancing federal loans is losing access to federal benefits and protections, such as income-driven repayment plans, loan forgiveness programs, and deferment options.

- By refinancing federal loans with a private lender, borrowers may be able to secure a lower interest rate, potentially saving money over the life of the loan.

- Refinancing federal loans may also simplify the repayment process by combining multiple loans into one monthly payment, making it easier to manage finances.

Benefits and Drawbacks of Refinancing Federal Loans with a Private Lender

- Benefits: Lower interest rates, potential savings over time, simplified repayment process.

- Drawbacks: Loss of federal benefits, potential higher overall costs if interest rates increase, fewer repayment options.

Considerations for Borrowers Deciding Whether to Refinance Federal Loans

- Before refinancing federal loans, borrowers should carefully assess their financial situation and long-term goals to determine if the benefits of refinancing outweigh the potential drawbacks.

- It is essential to compare the terms and conditions of the new private loan with the existing federal loans to ensure that refinancing makes financial sense.

- Borrowers should also consider their eligibility for federal loan forgiveness programs or income-driven repayment plans before deciding to refinance federal loans with a private lender.

Alternatives to Refinancing

When it comes to managing student loan debt, there are alternative options to refinancing that borrowers can explore. These alternatives include loan consolidation, income-driven repayment plans, and debt forgiveness programs. Each option comes with its own set of pros and cons, which should be carefully considered before making a decision.

Loan Consolidation

Loan consolidation involves combining multiple student loans into a single loan with a fixed interest rate. This can simplify the repayment process by combining all loans into one monthly payment. However, borrowers may end up paying more in interest over the life of the loan compared to refinancing.

Income-Driven Repayment Plans

Income-driven repayment plans adjust monthly payments based on the borrower’s income and family size. While this can make payments more manageable, it may result in a longer repayment period and higher overall interest payments. Borrowers should consider the impact on their long-term financial goals.

Debt Forgiveness Programs

Debt forgiveness programs offer loan forgiveness after a certain number of qualifying payments or through public service. While this can provide significant relief for borrowers, not all loans or professions are eligible for forgiveness. It’s important to understand the requirements and implications before pursuing this option.

Comparison Table

| Option | Pros | Cons |

|---|---|---|

| Refinancing | Lower interest rates, potential savings | Loss of federal loan benefits, may not qualify for lower rates |

| Loan Consolidation | Simplified repayment, fixed interest rate | Higher total interest payments |

| Income-Driven Repayment | Payments based on income, potential for loan forgiveness | Extended repayment period, higher overall interest |

| Debt Forgiveness | Potential for loan forgiveness | Eligibility requirements, limited professions |

Step-by-Step Guidance

For borrowers considering alternatives to refinancing, it’s important to research and understand the options available. To apply for loan consolidation, borrowers can contact their loan servicer or visit the federal student aid website for more information. Income-driven repayment plans can be enrolled in through the federal student aid website, and debt forgiveness programs typically require meeting specific criteria outlined by the program.

Impact of Economic Conditions

In the realm of student loan refinancing, economic conditions play a crucial role in shaping decisions and outcomes. Various factors, such as interest rate trends, inflation, and government policies, can significantly impact the refinancing landscape. Navigating these economic conditions requires a strategic approach to ensure the best possible outcomes for borrowers.

Interest Rate Trends and Refinancing Decisions

Interest rate trends have a direct influence on the decision to refinance student loans. When interest rates are low, borrowers may find it advantageous to refinance their loans to secure a lower rate and reduce overall interest costs. Conversely, during periods of high-interest rates, refinancing may not be as beneficial and could result in increased costs for borrowers.

- Monitoring interest rate trends is essential for borrowers considering refinancing.

- Consulting with financial advisors or loan experts can help borrowers navigate interest rate fluctuations.

- Timing refinancing decisions based on favorable interest rate trends can lead to significant savings over the life of the loan.

Government Policies and Economic Conditions

Government policies also play a crucial role in shaping economic conditions that affect student loan refinancing. For example, changes in federal student loan interest rates or repayment options can impact the attractiveness of refinancing options in the private market. Understanding these policy changes and their potential impact is essential for borrowers considering refinancing.

- Stay informed about government policies related to student loans and refinancing.

- Consider how changes in policies can affect your refinancing decisions.

- Consult with financial advisors or experts to understand the implications of government policies on student loan refinancing.

Fixed-Rate vs. Variable-Rate Refinancing Options

The choice between fixed-rate and variable-rate student loan refinancing options can also be influenced by economic conditions. Fixed-rate loans offer stability and predictable monthly payments, making them attractive during periods of economic uncertainty. On the other hand, variable-rate loans may offer lower initial rates but carry the risk of increasing costs if interest rates rise.

- Evaluate the pros and cons of fixed-rate and variable-rate refinancing options based on current economic conditions.

- Consider your risk tolerance and financial goals when choosing between fixed and variable rates.

- Monitor economic indicators that could impact interest rates to make informed decisions about refinancing options.

Case Studies and Success Stories

Exploring real-life examples of individuals who have successfully refinanced their student loans can provide valuable insights and inspiration for borrowers considering this financial decision.

Case Study 1: John Doe

- John Doe, a recent graduate burdened with high-interest student loans, decided to explore refinancing options to lower his monthly payments and interest rates.

- After researching various lenders and comparing offers, John chose to refinance his loans with a reputable financial institution that offered competitive rates.

- By refinancing, John was able to significantly reduce his interest rates and save thousands of dollars over the life of the loan.

- His monthly payments became more manageable, allowing him to allocate more funds towards other financial goals and investments.

Case Study 2: Sarah Smith

- Sarah Smith, a working professional with multiple student loans from different providers, was struggling to keep up with varying interest rates and payment schedules.

- Upon learning about student loan refinancing, Sarah decided to consolidate her loans into a single, more affordable loan with a fixed interest rate.

- Through the refinancing process, Sarah simplified her repayment plan, reduced her overall interest costs, and gained better control over her finances.

- She shared her success story with colleagues and friends, encouraging them to explore refinancing options to improve their financial situations.

Final Wrap-Up

In conclusion, student loan refinance offers a valuable opportunity to potentially save money and simplify your repayment journey. By weighing the benefits and drawbacks carefully, you can navigate this financial landscape with confidence and clarity.