Online Loans For Bad Credit: Accessing Financial Solutions For All

Online loans for bad credit offer a lifeline to individuals facing financial challenges, providing crucial support when traditional avenues may not be accessible. With a focus on inclusivity and convenience, these loans cater to those in need, regardless of their credit history.

Exploring the different types, pros and cons, application processes, and repayment options of online loans for bad credit can empower borrowers to make informed decisions and improve their financial well-being.

Importance of Online Loans for Bad Credit

Online loans for bad credit play a crucial role in providing financial assistance to individuals who may have struggled to obtain traditional loans due to their poor credit history. These online lending platforms offer a lifeline to those in need of immediate funds, despite their less-than-perfect credit scores.

Increased Access to Financial Assistance

Online loans have significantly expanded access to financial assistance for individuals with bad credit. In the past, traditional financial institutions often rejected loan applications from individuals with poor credit scores, leaving them with limited options in times of financial need. However, online lenders are more willing to consider other factors beyond credit scores, such as income, employment status, and repayment ability, making it easier for individuals with bad credit to secure a loan.

Emergency Situations

Online loans are especially crucial during emergency situations, such as unexpected medical expenses, car repairs, or other urgent financial needs. For individuals with bad credit who may not have savings or access to traditional loans, online lenders provide a quick and convenient solution to address these pressing financial issues.

Building Credit History

For individuals looking to rebuild their credit history, online loans can serve as a valuable tool. By responsibly managing an online loan and making timely repayments, individuals with bad credit can demonstrate their creditworthiness and improve their credit scores over time. This positive credit behavior can open up more opportunities for financial assistance in the future.

Types of Online Loans for Bad Credit

When it comes to online loans for individuals with bad credit, there are several types available to choose from. Each type has its own features, benefits, and eligibility criteria. Let’s explore some of the common types of online loans for bad credit below.

Short-Term Online Loans for Bad Credit

Short-term online loans are typically smaller in amount and have a shorter repayment period, usually ranging from a few weeks to a few months. These loans are often used for emergency expenses and can be obtained quickly. However, they may come with higher interest rates compared to long-term loans.

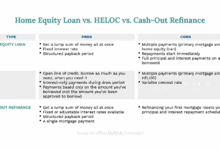

Long-Term Online Loans for Bad Credit

Long-term online loans, on the other hand, offer larger loan amounts and longer repayment terms, which can extend up to several years. These loans are suitable for larger expenses such as home renovations or debt consolidation. While long-term loans may have lower interest rates, the total amount repaid over the term may be higher due to the extended repayment period.

Eligibility Criteria for Online Loans for Bad Credit

The eligibility criteria for online loans for bad credit can vary depending on the type of loan and the lender. However, some common requirements include a minimum age of 18 years, a steady income source, a valid bank account, and proof of identity. Lenders may also consider factors such as employment history and debt-to-income ratio when assessing eligibility for a loan.

Pros and Cons of Online Loans for Bad Credit

When it comes to online loans for individuals with bad credit, there are both advantages and disadvantages to consider. Understanding the pros and cons can help you make an informed decision when seeking financial assistance.

Advantages of Online Loans for Bad Credit

- Accessibility: Online loans are easily accessible, allowing individuals with bad credit to apply from the comfort of their own homes.

- Quick Approval: Online lenders often provide quick approval decisions, allowing borrowers to receive funds in a timely manner.

- Flexible Terms: Some online lenders offer flexible repayment terms, making it easier for borrowers to manage their payments.

- Comparison Shopping: Online platforms allow borrowers to compare multiple loan options, ensuring they find the best terms for their situation.

Potential Drawbacks of Online Loans for Bad Credit

- Higher Interest Rates: Due to the increased risk associated with bad credit, online loans may come with higher interest rates compared to traditional loans.

- Scams: There is a risk of falling victim to online loan scams, so it’s important to research and choose reputable lenders.

- Debt Trap: Borrowers with bad credit may find themselves in a cycle of debt if they are unable to make timely repayments on their online loans.

Tips to Mitigate Disadvantages of Online Loans for Bad Credit

- Improve Credit Score: Work on improving your credit score before applying for an online loan to potentially qualify for better terms.

- Research Lenders: Take the time to research and read reviews of online lenders to ensure they are legitimate and trustworthy.

- Budget Wisely: Create a budget and ensure you can comfortably afford the repayment terms of the online loan before borrowing.

- Consider Alternatives: Explore alternative options such as credit unions or personal loans from family and friends before turning to online loans.

Applying for Online Loans with Bad Credit

When applying for online loans with bad credit, it’s important to follow a step-by-step process to increase your chances of approval and secure favorable terms. Additionally, understanding the documentation required, best practices for approval, reputable lenders, and the impact on your credit score are crucial aspects to consider.

Step-by-Step Process of Applying for Online Loans with Bad Credit

- Research and compare online lenders specializing in bad credit loans.

- Check eligibility requirements and ensure you meet them.

- Gather necessary documentation, such as proof of income, identification, and bank statements.

- Fill out the online application form accurately and honestly.

- Submit your application and wait for a decision from the lender.

Documentation Required when Applying for Online Loans with Bad Credit

- Proof of income (pay stubs, tax returns).

- Identification (driver’s license, passport).

- Bank statements.

- Proof of residence.

Best Practices for Improving Chances of Approval

- Check your credit report for errors and dispute any inaccuracies.

- Apply for loans you are likely to qualify for based on your credit score.

- Consider a co-signer with good credit to strengthen your application.

Reputable Online Lenders Specializing in Bad Credit Loans

- LendingClub

- Avant

- OneMain Financial

Importance of Comparing Interest Rates, Terms, and Fees

- Comparing different lenders allows you to choose the most affordable option.

- Understanding the total cost of the loan helps you plan for repayments.

Calculating the Total Cost of the Loan

Loan Amount + Interest + Fees = Total Cost

Impact of Applying for Multiple Online Loans on Your Credit Score

- Applying for multiple loans can lower your credit score temporarily due to hard inquiries.

- To minimize the impact, apply for loans within a short period to group inquiries as one.

Building or Repairing Your Credit Score

- Pay bills on time to establish a positive payment history.

- Reduce credit card balances to improve your credit utilization ratio.

- Consider a secured credit card to build credit with responsible use.

Interest Rates and Fees for Online Loans with Bad Credit

When it comes to online loans for individuals with bad credit, understanding the interest rates and fees involved is crucial in making informed financial decisions. Let’s delve into how interest rates are structured, common fees associated, and strategies for finding the most affordable options.

Interest Rates for Online Loans with Bad Credit

Interest rates for online loans catering to individuals with bad credit tend to be higher compared to traditional loans. Lenders view borrowers with bad credit as high-risk, leading to higher interest rates to offset this risk. It’s essential to carefully review and compare interest rates from different lenders to find the most competitive option. Additionally, some lenders may offer fixed or variable interest rates, so be sure to understand the terms before committing to a loan.

Common Fees Associated with Online Loans for Bad Credit

In addition to interest rates, borrowers should be aware of common fees that may be associated with online loans for bad credit. These fees can include origination fees, late payment fees, prepayment penalties, and administrative fees. These fees can significantly impact the overall cost of the loan, so it’s important to carefully review the terms and conditions to understand the full cost of borrowing.

Strategies for Finding Affordable Online Loans for Bad Credit

To find the most affordable online loans for individuals with bad credit, consider the following strategies:

- Compare interest rates and fees from multiple lenders to find the best overall deal.

- Improve your credit score before applying for a loan to potentially qualify for lower interest rates.

- Avoid borrowing more than you need to reduce the total cost of the loan.

- Look for lenders that offer flexible repayment terms and options to better manage your finances.

- Consider alternative lending options such as credit unions or online peer-to-peer lending platforms.

By being proactive and thorough in your research, you can find an online loan that meets your financial needs while minimizing the impact of high interest rates and fees.

Repayment Terms and Options for Online Loans for Bad Credit

When it comes to online loans for bad credit, understanding the repayment terms and options is crucial for borrowers to manage their finances effectively and avoid any potential pitfalls.

Common Repayment Terms

- Monthly Installments: Many online lenders offer the option to repay the loan in monthly installments, making it easier for borrowers to budget and plan their payments.

- Bi-weekly Payments: Some lenders may provide the choice of bi-weekly payments, which can help borrowers pay off the loan faster and reduce the overall interest paid.

- Lump-sum Payments: In some cases, borrowers may have the flexibility to make lump-sum payments to clear the loan before the scheduled term, potentially saving on interest costs.

Implications of Late Payments or Default

Late payments or defaulting on online loans for bad credit can lead to additional fees, a negative impact on credit scores, and potential legal action by the lender to recover the outstanding amount.

Interest Rates and Fees

- Typical interest rates for online loans for bad credit can vary but are generally higher than traditional loans to offset the risk for lenders.

- Additional fees such as origination fees, late payment fees, and prepayment penalties may also apply, so borrowers should carefully review the terms before accepting the loan.

Loan Renewal or Extension

- For borrowers with bad credit, loan renewal or extension options may be limited, and it’s essential to communicate with the lender in advance if facing difficulties in repaying the loan on time.

- Extensions may incur additional fees or interest, so borrowers should weigh the costs and benefits before opting for this solution.

Effective Communication with Lenders

- If experiencing financial hardships, borrowers should proactively reach out to their lenders to discuss possible alternatives or hardship programs that could help them navigate through challenging times.

- Being transparent about the situation and demonstrating a willingness to collaborate can often lead to more favorable outcomes and potentially avoid defaulting on the loan.

Building Credit with Online Loans for Bad Credit

Building credit with online loans for bad credit is a strategic way for individuals to improve their credit score and establish a positive credit history. Timely repayment and responsible use of these loans can pave the way for better financial opportunities in the future.

Leveraging Online Loans for Bad Credit

When it comes to leveraging online loans for bad credit to rebuild a positive credit history, there are a few key tips to keep in mind:

- Make timely repayments: Ensure that you make on-time payments for your online loans to demonstrate responsible borrowing behavior.

- Borrow only what you need: Avoid taking out more than you can afford to repay, as this can lead to financial strain and negatively impact your credit score.

- Diversify your credit mix: Consider using a combination of credit types, such as credit cards and installment loans, to show lenders that you can manage different forms of credit responsibly.

Long-Term Impact of Responsible Use

Using online loans responsibly can have a lasting impact on your creditworthiness. By consistently making timely payments and managing your debt effectively, you can gradually improve your credit score over time and increase your chances of qualifying for better loan terms and interest rates in the future.

Setting Up Automated Payments

Setting up automated payments for your online loans is a great way to ensure that you never miss a payment. Follow these steps to set up automated payments:

- Log in to your loan account.

- Look for the option to set up automatic payments.

- Enter your payment information and select the date you want the payment to be processed.

- Review and confirm your settings to activate automated payments.

Monitoring Credit Reports

It is important to monitor your credit reports regularly while utilizing online loans for bad credit. This allows you to track your progress, identify any errors or discrepancies, and ensure that your credit information is up to date.

Alternative Credit-Building Strategies

In addition to using online loans for bad credit, there are other alternative credit-building strategies that can complement your efforts, such as:

- Secured credit cards: These cards require a security deposit but can help you build credit with responsible use.

- Credit builder loans: These loans are designed specifically to help individuals establish or improve their credit history.

- Becoming an authorized user: Being added as an authorized user on someone else’s credit card can potentially boost your credit score.

Alternatives to Online Loans for Individuals with Bad Credit

When individuals with bad credit are looking for financial assistance, there are several alternatives to online loans that they can consider. These options may vary in terms of eligibility criteria, interest rates, and repayment terms, so it’s essential to explore each one carefully to determine the best fit for their specific situation.

Credit Unions

Credit unions are member-owned financial cooperatives that often offer loans to individuals with bad credit. These institutions tend to have lower interest rates compared to traditional banks and are more willing to work with borrowers who have less-than-perfect credit histories. However, eligibility criteria may still apply, such as membership requirements or specific credit score thresholds.

Payday Loans

Payday loans are short-term, high-interest loans that are typically available to individuals with bad credit. While these loans can provide quick access to cash, they often come with exorbitant interest rates and fees. Borrowers should proceed with caution and carefully review the terms and conditions before taking out a payday loan.

Secured Loans

Secured loans require collateral, such as a car or a savings account, to secure the loan. Individuals with bad credit may have a higher chance of approval for a secured loan since the lender has a guarantee in case of default. However, borrowers should be aware that failure to repay a secured loan could result in the loss of the collateral.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual investors willing to fund their loans. These platforms may offer more flexibility in terms of eligibility criteria and interest rates, making them a viable alternative for individuals with bad credit. Borrowers can create a listing detailing their loan request and wait for investors to fund their loan.

Avoiding Predatory Lenders in the Online Loans Market

Online loans for bad credit can be a lifesaver for individuals in need of financial assistance, but it’s crucial to be cautious when choosing a lender. Predatory lenders often target those with poor credit scores, trapping them in cycles of debt. Here are some tips to help you avoid falling victim to predatory lending practices.

Identifying Red Flags

- Unsolicited offers with high-pressure sales tactics

- No physical address or contact information provided

- Guaranteed approval regardless of credit history

- Asking for upfront fees or payments

Protecting Yourself

- Research the lender’s reputation and read reviews from other borrowers

- Check for proper licensing and accreditation

- Avoid lenders who are not transparent about their fees and terms

- Trust your instincts and walk away if something feels off

Criteria for Legitimate Lenders

| Lender | Interest Rate | Hidden Fees | Repayment Terms |

|---|---|---|---|

| Lender A | 12% | No hidden fees | 12-24 months |

| Lender B | 15% | Application fee | 6-18 months |

| Lender C | 18% | Origination fee | 9-36 months |

Verifying Lender’s Credentials

- Check the lender’s website for licensing information

- Verify accreditation with relevant regulatory bodies

- Contact consumer protection agencies for any complaints against the lender

It’s essential to do your due diligence and ensure you’re dealing with a reputable lender to avoid falling into the hands of predatory lenders.

Regulations and Consumer Rights for Online Loans for Bad Credit

When it comes to online loans for bad credit, there are specific regulations in place to govern the operations of lenders catering to individuals with poor credit histories. These regulations aim to protect consumers from unfair practices and ensure transparency in the lending process.

Regulatory Framework for Online Lenders

Online lenders offering loans for bad credit are required to adhere to state and federal laws that govern the lending industry. These regulations may include caps on interest rates, restrictions on fees, and guidelines on loan terms. It is essential for borrowers to familiarize themselves with these regulations to avoid falling prey to predatory lending practices.

Consumer Rights and Protections

Borrowers seeking online loans for bad credit are entitled to certain rights and protections to safeguard their interests. These may include the right to receive clear and accurate information about loan terms, the right to dispute any discrepancies, and the right to fair treatment throughout the lending process. Additionally, borrowers have the right to file complaints with regulatory authorities in case of any misconduct by the lender.

Resources for Borrowers

For individuals looking to learn more about their rights and responsibilities when dealing with online lenders, there are resources available to provide guidance. Websites such as the Consumer Financial Protection Bureau (CFPB) offer valuable information on consumer rights, tips for borrowing responsibly, and tools for comparing loan offers. Borrowers can also seek assistance from non-profit organizations and financial counselors to ensure they are making informed decisions when taking out online loans for bad credit.

Case Studies

In this section, we will explore real-life examples of individuals who have successfully utilized online loans for bad credit to overcome financial challenges. These case studies will highlight the journey of borrowers from application to repayment, showcasing key milestones and outcomes that can inspire others facing similar situations.

Case Study 1: Overcoming Medical Expenses

- Alex, a single parent with bad credit, faced unexpected medical expenses for his child.

- He applied for an online loan and received quick approval despite his credit history.

- With the funds, Alex was able to cover the medical bills and ensure his child received the necessary treatment.

- Through timely repayments, Alex improved his credit score and financial stability.

Case Study 2: Debt Consolidation Success

- Sarah, a recent graduate burdened with multiple debts and a low credit score, decided to consolidate her loans.

- She opted for an online loan with favorable terms and used it to pay off her existing debts.

- By consolidating her loans, Sarah simplified her repayment process and saved on interest payments.

- With disciplined budgeting and timely repayments, Sarah was able to boost her credit score over time.

Lessons Learned and Inspirations

- These case studies demonstrate that online loans for bad credit can be a valuable tool for individuals facing financial hardships.

- Timely access to funds, flexible repayment options, and the opportunity to rebuild credit are key benefits of utilizing online loans.

- By learning from the experiences of Alex and Sarah, others with bad credit can find motivation to take control of their finances and work towards a brighter financial future.

Financial Literacy and Education for Borrowers with Bad Credit

Financial literacy is crucial for individuals with bad credit who are considering online loans. Having a solid understanding of financial concepts can help borrowers make informed decisions, avoid predatory lenders, and work towards improving their credit standing. Here are some key points to consider:

Importance of Financial Literacy

- Financial literacy empowers borrowers to understand the terms and conditions of online loans, including interest rates and fees.

- It helps individuals in making responsible financial decisions, managing their budgets, and avoiding falling into debt traps.

- By educating themselves on financial matters, borrowers can take control of their financial futures and work towards rebuilding their credit scores.

Key Factors Contributing to Bad Credit

- Missed payments, high credit card balances, and maxed-out credit lines can all contribute to a poor credit score.

- Lack of budgeting and financial planning can lead to overspending and accumulating debt.

- Identity theft and errors on credit reports can also negatively impact credit scores.

Common Financial Mistakes to Avoid

- Not checking credit reports regularly for errors or discrepancies.

- Ignoring bills or missing payments, which can further damage credit scores.

- Applying for multiple loans or credit cards within a short period, which can signal financial distress to lenders.

Creating a Budget and Sticking to It

- Track income and expenses to identify areas where spending can be reduced.

- Allocate funds for essentials like housing, utilities, and food before discretionary spending.

- Set aside a portion of income for savings and emergency expenses to avoid relying on credit in times of need.

Resources for Financial Education

- Financial literacy websites like NerdWallet, Credit Karma, and The Balance offer valuable information on credit management and personal finance.

- Non-profit organizations like the National Foundation for Credit Counseling (NFCC) provide free credit counseling and financial education services.

- Local community centers or libraries may offer workshops or seminars on budgeting, debt management, and credit repair.

Future Trends in Online Lending for Individuals with Bad Credit

Online lending for individuals with bad credit is a dynamic industry that continues to evolve. Several trends are expected to shape the future landscape of online loans for those with poor credit scores.

Impact of Artificial Intelligence and Machine Learning Algorithms

With the advancement of technology, artificial intelligence (AI) and machine learning algorithms are increasingly being utilized in the approval process of online loans for individuals with bad credit. These technologies can analyze vast amounts of data to assess creditworthiness more accurately and efficiently.

Role of Blockchain Technology in Lending

Blockchain technology has the potential to revolutionize the online lending industry by providing secure and transparent lending solutions for individuals with poor credit scores. The decentralized nature of blockchain can enhance trust and reduce the risk of fraud in lending transactions.

Integration of Biometric Data in Credit Assessment

The future of online lending may see the integration of biometric data, such as fingerprint or facial recognition, in assessing the creditworthiness of borrowers with bad credit. This approach can add an extra layer of security and accuracy to the lending process.

Ethical Implications of Alternative Data Sources

As lenders explore alternative data sources like social media behavior to determine loan eligibility for individuals with bad credit, ethical considerations come into play. It is essential to address privacy concerns and ensure that the use of such data is fair and transparent.

Final Conclusion

In conclusion, online loans for bad credit bridge the gap between financial constraints and necessary funds, offering a pathway to stability and growth for those in need. By understanding the nuances of online lending, individuals can navigate the borrowing landscape with confidence and resilience.