Low Interest Personal Loans: Types, Qualifications, And Repayment Strategies

Low interest personal loans offer a viable financial solution for many individuals. From understanding the different types to qualifying for them and managing repayments, this comprehensive guide delves into the intricacies of low interest personal loans.

What are the key features of ketogenic diet?

A ketogenic diet is a high-fat, low-carbohydrate eating plan that aims to induce a state of ketosis in the body. Ketosis occurs when the body switches from using glucose as its primary source of energy to burning fat for fuel. This process can lead to weight loss and improved metabolic health.

Types of Food Allowed and Prohibited

When following a ketogenic diet, individuals are encouraged to consume foods high in healthy fats, moderate in protein, and very low in carbohydrates. Foods allowed on a ketogenic diet include:

- Fatty fish

- Avocados

- Nuts and seeds

- Leafy greens

Prohibited foods typically include sugary items, grains, fruits high in sugar, and processed foods.

Benefits of Following a Ketogenic Diet

- Weight loss: By reducing carbohydrate intake, the body burns stored fat for energy, leading to weight loss.

- Improved blood sugar control: Ketogenic diets can help regulate blood sugar levels and reduce insulin resistance.

- Mental clarity: Many people report increased focus and cognitive function while following a ketogenic diet.

Meal Plans for Beginners

For beginners, a sample ketogenic meal plan might include:

| Meal | Food |

|---|---|

| Breakfast | Scrambled eggs with spinach and avocado |

| Lunch | Grilled chicken salad with olive oil dressing |

| Dinner | Salmon with asparagus and butter sauce |

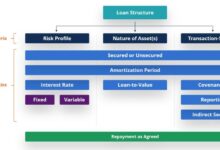

Types of low interest personal loans

When it comes to low interest personal loans, there are several types available in the market to suit different financial needs. Below, we will explore the different types, compare secured vs. unsecured options, provide examples of financial institutions that offer these loans, and explain the eligibility criteria for each type.

Secured vs. Unsecured Low Interest Personal Loans

- Secured Personal Loans: These loans require collateral, such as a car or property, to secure the loan. The interest rates are typically lower as there is less risk for the lender in case of default.

- Unsecured Personal Loans: These loans do not require collateral, making them a good option for those who do not have assets to use as security. However, the interest rates are usually higher compared to secured loans.

Examples of Financial Institutions Offering Low Interest Personal Loans

- Bank of America: Offers competitive rates for both secured and unsecured personal loans.

- Wells Fargo: Provides low interest personal loans with flexible repayment terms.

- Discover: Known for its transparent pricing and quick approval process for personal loans.

Eligibility Criteria for Different Types of Low Interest Personal Loans

- Secured Personal Loans: Applicants must have a valuable asset to use as collateral, a good credit score, and a stable income.

- Unsecured Personal Loans: Lenders will consider the applicant’s credit score, income, employment history, and debt-to-income ratio to determine eligibility.

Factors influencing interest rates

Interest rates on personal loans are influenced by various factors that play a significant role in determining the cost of borrowing money. These factors include inflation rates, central bank policies, market competition, credit scores, loan amounts, loan terms, and overall economic conditions.

Inflation Rates, Central Bank Policies, and Market Competition

- Inflation rates: High inflation rates typically lead to higher interest rates as lenders adjust to maintain the real value of their returns.

- Central bank policies: The decisions made by central banks regarding monetary policy, such as adjusting interest rates, can directly impact the interest rates on personal loans.

- Market competition: Intense competition among lenders can lead to lower interest rates as they strive to attract borrowers.

Credit Score Impact

- Credit score ranges: For example, borrowers with excellent credit scores (above 800) may qualify for the lowest interest rates, while those with poor credit scores (below 600) may face higher interest rates.

- Interest rate brackets: The interest rates offered to borrowers are often segmented into brackets based on credit scores to reflect the level of risk associated with the borrower.

Loan Amount and Loan Term Influence

The loan amount and loan term also play a crucial role in determining interest rates on personal loans. Lenders may offer different interest rates based on the amount borrowed and the duration of the loan. The table below illustrates how interest rates can vary:

| Loan Amount | Loan Term | Interest Rate |

|---|---|---|

| $5,000 | 3 years | 8% |

| $10,000 | 5 years | 6.5% |

| $20,000 | 7 years | 5% |

Economic Conditions Impact

- GDP growth: Strong economic growth can lead to higher interest rates to curb inflation.

- Unemployment rates: High unemployment rates may result in lower interest rates to stimulate borrowing and spending.

- Inflation levels: Inflation levels above the target rate may prompt lenders to raise interest rates to protect their returns.

Calculation of Interest Rates

Interest rates on personal loans are calculated based on various factors, including the borrower’s creditworthiness, loan amount, loan term, and prevailing economic conditions. Lenders use a formula that takes into account these components to determine the final interest rate offered to the borrower.

How to qualify for low interest personal loans

Qualifying for low interest personal loans can be a great way to secure affordable financing for various needs. Here is a step-by-step guide on how to qualify for these loans:

Importance of a good credit score

- Having a good credit score is crucial in obtaining low interest rates on personal loans.

- Lenders use credit scores to assess the borrower’s creditworthiness and ability to repay the loan.

- Improving your credit score can help you secure better loan terms and lower interest rates.

Tips for improving creditworthiness

- Pay your bills on time to show responsible financial behavior.

- Reduce your outstanding debt and keep credit card balances low.

- Check your credit report regularly for errors and dispute any inaccuracies.

Documentation required for application

- Proof of income such as pay stubs or tax returns.

- Identification documents like a driver’s license or passport.

- Bank statements to show your financial stability.

Comparison table of interest rates

| Lender | Interest Rate |

|---|---|

| Lender A | 5.99% |

| Lender B | 6.25% |

| Lender C | 4.75% |

The terms and conditions of a loan can significantly impact the total repayment amount, so it’s important to carefully review and understand them before signing.

Key factors lenders consider

- Income stability and employment history.

- Debt-to-income ratio.

- Credit history and credit score.

- Collateral (if applicable).

Pros and cons of low interest personal loans

When considering low interest personal loans, it is important to weigh the advantages and disadvantages to make an informed decision. Here, we explore the pros and cons to help you understand the implications of opting for such financial products.

Advantages of low interest personal loans

- Low interest rates can result in significant savings on interest payments over the life of the loan, making it a cost-effective borrowing option.

- Fixed monthly payments make budgeting easier and provide predictability in managing financial obligations.

- Opportunity to consolidate high-interest debt into a single, more manageable loan with a lower interest rate, potentially saving money in the long run.

Drawbacks of low interest personal loans

- Stringent eligibility criteria may limit access for borrowers with lower credit scores or unstable financial histories, making approval challenging for some individuals.

- Origination fees or prepayment penalties may offset some of the savings from the lower interest rates, increasing the overall cost of the loan.

- Defaulting on a low interest personal loan can still have serious consequences, affecting credit scores and financial stability.

Real-life examples of benefits

Low interest personal loans can be particularly beneficial in scenarios such as:

- Consolidating credit card debt with high interest rates into a single loan with a lower interest rate, reducing overall interest costs.

- Funding home improvements or renovations at a lower cost compared to using credit cards or other high-interest financing options.

Considerations before applying

- Compare offers from multiple lenders to find the best terms and interest rates that suit your financial situation.

- Understand the impact of a new loan on your credit score and overall financial health before committing to a low interest personal loan.

Alternatives to Low Interest Personal Loans

When considering financing options, individuals may explore various alternatives to low interest personal loans. It is essential to compare these alternatives with low interest personal loans to make an informed decision based on specific financial needs and circumstances.

Credit Cards

Credit cards are a common form of consumer credit that allows individuals to make purchases on credit. While credit cards offer convenience and flexibility, they often come with high-interest rates compared to low interest personal loans. It is crucial to manage credit card debt responsibly to avoid accumulating high-interest charges.

Payday Loans

Payday loans are short-term loans typically used for emergency expenses. These loans usually come with high-interest rates and fees, making them a costly form of borrowing. Borrowers should be cautious when considering payday loans due to their high cost and potential for debt traps.

Home Equity Loans

Home equity loans allow homeowners to borrow against the equity in their homes. These loans typically have lower interest rates compared to personal loans and credit cards. However, borrowers risk losing their homes if they fail to repay the loan, making it a high-stakes financing option.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual investors willing to fund their loans. Interest rates on peer-to-peer loans can vary depending on the borrower’s creditworthiness. While peer-to-peer lending offers an alternative to traditional banks, borrowers should carefully review the terms and conditions of the loan.

Tips for comparing low interest personal loan offers

When comparing low interest personal loan offers, it is crucial to carefully assess various factors to ensure you are getting the best deal possible. Here are some tips to help you effectively compare different loan options:

Create a Detailed Spreadsheet

- List out key details such as interest rates, loan amounts, repayment terms, and any additional fees for each loan offer.

- Having all the information in one place will make it easier to compare and analyze the different loan options available to you.

Evaluate Loan Terms and Conditions

- Consider the total cost of the loan, including any fees or charges, to determine the overall affordability of the loan.

- Look into repayment flexibility, prepayment penalties, and the reputation of the lender to ensure you are comfortable with the terms and conditions.

Checklist for Assessing Loan Options

- Review your credit score to understand what loan offers you may qualify for.

- Calculate the total interest paid over the life of the loan to compare the long-term cost of each offer.

- Compare offers from at least three different lenders to ensure you are getting the best deal.

Negotiate for Better Terms

- Use competitor offers to negotiate for better terms with your preferred lender.

- Highlight your strong credit history to potentially secure lower interest rates or more favorable loan terms.

- Be prepared to walk away if the terms offered are not in your best interest.

Repayment strategies for low interest personal loans

When it comes to repaying low interest personal loans, borrowers have several strategies at their disposal to manage their repayments efficiently and save on interest costs. By understanding the impact of different repayment schedules and making informed decisions, borrowers can reduce the overall interest paid and pay off their loans faster.

Making Extra Payments Towards Principal

- One effective strategy is to make extra payments towards the principal amount of the loan. By reducing the principal balance, borrowers can lower the amount of interest accrued over time.

-

Even small additional payments can have a significant impact on the total interest paid and shorten the loan term.

Bi-weekly Payments vs. Monthly Payments

- Another strategy is to consider making bi-weekly payments instead of monthly payments. This approach can result in interest savings over the life of the loan.

-

Bi-weekly payments allow borrowers to make 26 half-payments per year, which is equivalent to 13 full payments. This extra payment can help reduce the principal balance faster.

Debt Snowball or Debt Avalanche Methods

- Debt snowball and debt avalanche methods are popular approaches to paying off multiple debts, including personal loans. These methods involve prioritizing debts based on either balance or interest rate.

-

The debt snowball method focuses on paying off the smallest debt first, while the debt avalanche method targets the debt with the highest interest rate.

Negotiating with Lenders

- Borrowers can also explore the option of negotiating with lenders to lower interest rates or modify repayment terms. This can help reduce the overall cost of the loan and make repayments more manageable.

-

It’s important to communicate openly with lenders and provide valid reasons for requesting changes to the loan terms.

Sample Repayment Schedule

- Creating a sample repayment schedule using a hypothetical loan amount and interest rate can help borrowers visualize the impact of different repayment strategies.

-

By inputting various payment amounts and frequencies into a loan calculator, borrowers can see how making extra payments or changing the repayment schedule affects the total interest paid and the loan term.

Common misconceptions about low interest personal loans

Low interest personal loans are a popular financial product, but there are several misconceptions surrounding them that can lead to confusion among borrowers. Let’s address some of the common myths and provide clarifications to help you make informed decisions.

Misconception 1: Low interest personal loans are only for people with perfect credit

While having a good credit score can certainly help you qualify for a lower interest rate, it is not the only factor that lenders consider. Many lenders also take into account other factors such as income, employment history, and debt-to-income ratio when assessing loan applications. Therefore, even if you don’t have a perfect credit score, you may still be eligible for a low interest personal loan.

Misconception 2: Applying for a low interest personal loan is a complicated process

Contrary to popular belief, applying for a low interest personal loan is often a straightforward process. Many lenders offer online applications that can be completed in minutes, and approval decisions are typically made quickly. As long as you provide the necessary documentation and meet the eligibility criteria, obtaining a low interest personal loan can be a seamless experience.

Misconception 3: Low interest personal loans always have hidden fees

While it’s true that some lenders may charge fees in addition to the interest rate, not all low interest personal loans come with hidden fees. It’s important to carefully review the terms and conditions of the loan agreement to understand any potential fees that may apply. By doing your research and choosing a reputable lender, you can avoid unexpected fees and ensure that you are getting a truly low interest personal loan.

Understanding the fine print of low interest personal loans

When considering taking out a low interest personal loan, it is crucial to thoroughly read and understand the terms and conditions associated with the loan agreement. Failing to do so could lead to unexpected fees, penalties, or other unfavorable terms down the line.

Key Clauses to Look Out For

- Interest Rate: Understand whether the interest rate is fixed or variable, and if there are any introductory rates that may increase after a certain period.

- Fees and Charges: Take note of any origination fees, prepayment penalties, or late payment fees that may impact the overall cost of the loan.

- Repayment Terms: Review the repayment schedule, including the length of the loan term, monthly payment amounts, and any provisions for early repayment.

Interpreting Financial Jargon

- APR (Annual Percentage Rate): This includes not just the interest rate, but also any additional fees, making it a more accurate representation of the total cost of borrowing.

- Grace Period: The amount of time you have after a missed payment before a late fee is charged.

- Collateral: Any asset you pledge to secure the loan, which could be seized by the lender if you default on payments.

Seeking Clarification

If you come across any terms or clauses in the loan agreement that are unclear, do not hesitate to reach out to the lender for clarification. It is better to fully understand the terms upfront rather than facing surprises later on in the loan repayment process.

Impact of low interest personal loans on credit score

Taking out low interest personal loans can have a significant impact on one’s credit score. Here’s how it works:

Relationship between loan repayment behavior and credit score

- Timely repayment of low interest personal loans can positively impact credit score.

- Consistently making payments on time demonstrates financial responsibility and can improve creditworthiness.

- On the other hand, missing payments or defaulting on a loan can lower credit score significantly.

Strategies for using low interest personal loans to improve creditworthiness

- Make timely payments consistently to show good repayment behavior.

- Keep credit utilization low to maintain a healthy credit score.

- Use low interest personal loans to pay off high-interest debt, which can positively impact credit score.

Tips on avoiding actions that could negatively impact credit score when availing low interest personal loans

- Avoid taking on more debt than you can afford to repay.

- Avoid missing payments or making late payments on your loan.

- Avoid opening multiple lines of credit at the same time, as this can lower your credit score.

Case studies on successful utilization of low interest personal loans

Low interest personal loans have been instrumental in helping individuals and businesses achieve their financial goals. Let’s explore some real-life examples of successful utilization of low interest personal loans.

Debt Consolidation Success Story

One individual, let’s call her Sarah, was struggling with multiple high-interest debts from credit cards and personal loans. By consolidating her debts into a single low interest personal loan, Sarah was able to save on interest payments and simplify her repayment process. She qualified for the loan by demonstrating a steady income and a good credit score.

Home Improvement Project Case Study

John wanted to renovate his home but lacked the upfront funds needed for the project. He opted for a low interest personal loan to finance the renovations. John carefully compared loan offers to find the best rates and terms. Through disciplined budgeting and timely repayments, John successfully completed his home improvement project without straining his finances.

Small Business Startup Example

Entrepreneurial couple, Tom and Lisa, dreamt of starting their own small business but needed seed capital. They secured a low interest personal loan to kickstart their venture. By presenting a detailed business plan and demonstrating their commitment to the venture, Tom and Lisa were able to qualify for the loan. With strategic planning and efficient use of funds, their business thrived, showcasing the positive impact of low interest personal loans on entrepreneurial endeavors.

Trends and future outlook of low interest personal loans

Personal loans have seen a significant rise in popularity, with more and more people opting for them to meet various financial needs. Low interest personal loans, in particular, have garnered attention due to their cost-effectiveness. Let’s delve into the current trends and future outlook of low interest personal loans.

Current Trends in Low Interest Personal Loans

- The demand for low interest personal loans is on the rise as consumers look for affordable borrowing options.

- Lenders are offering competitive interest rates to attract borrowers, leading to a more borrower-friendly market.

- Online lenders are gaining popularity for their quick approval processes and convenient loan application methods.

Impact of Economic Factors and Regulatory Changes

- Economic factors such as inflation rates and central bank policies can influence interest rates on personal loans.

- Regulatory changes in the financial sector can impact the availability and terms of low interest personal loans.

- Changes in the overall economy, such as recessions or economic booms, can also affect the interest rates offered on personal loans.

Potential Developments in Low Interest Personal Loan Offerings

- Introduction of innovative loan products with flexible repayment options tailored to individual needs.

- Integration of technology to streamline the loan application and approval process, making it more efficient for borrowers.

- Increase in partnerships between traditional financial institutions and fintech companies to offer competitive low interest personal loan products.

Expert Opinions on the Future Outlook

Experts predict a continued growth in the low interest personal loan market, with lenders focusing on providing personalized and affordable borrowing solutions to meet the diverse needs of consumers.

Last Recap

Exploring the realm of low interest personal loans opens up a world of possibilities for prudent financial management. By grasping the nuances discussed here, individuals can navigate the landscape of personal loans with confidence and clarity.