Loans For Bad Credit: Finding The Right Financial Solution

Loans for bad credit are a crucial financial tool for individuals facing credit challenges, offering a lifeline when traditional options seem out of reach. As we delve into the realm of bad credit loans, a world of possibilities and opportunities awaits those seeking to improve their financial standing.

Types of loans available for bad credit applicants

When it comes to individuals with bad credit, there are still several types of loans available to help them access the funds they need. These loans cater to different financial needs and situations, providing options for those who may have been turned down by traditional lenders.

Personal Loans

Personal loans are a common option for bad credit applicants. These loans are typically unsecured, meaning they do not require collateral. However, the interest rates for personal loans for bad credit may be higher compared to those with good credit. Eligibility criteria often include proof of income and employment, along with a minimum credit score requirement.

Payday Loans

Payday loans are short-term loans that are typically due on the borrower’s next payday. These loans are easier to qualify for, even with bad credit, but they come with high interest rates and fees. Borrowers must provide proof of income and have an active checking account to qualify for a payday loan.

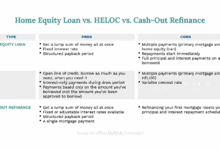

Secured Loans

Secured loans require collateral, such as a car or home, to secure the loan. While bad credit may not be a huge factor in securing a secured loan, borrowers risk losing their collateral if they fail to repay the loan. Interest rates for secured loans may be lower compared to unsecured options.

Credit Union Loans

Credit unions often offer more flexible terms and lower interest rates compared to traditional banks. Bad credit applicants may have a better chance of approval with a credit union loan, especially if they have a steady income and are a member of the credit union.

Peer-to-Peer Loans

Peer-to-peer loans involve borrowing from individual investors instead of a financial institution. These loans may have varying interest rates and terms based on the investor’s risk assessment. Bad credit applicants may find it easier to qualify for a peer-to-peer loan compared to traditional loans.

Online Installment Loans

Online installment loans provide borrowers with a fixed repayment schedule and interest rate. Bad credit applicants can often qualify for these loans, but they may come with higher interest rates. Borrowers must provide proof of income and have a valid bank account to qualify.

Factors to consider when applying for loans with bad credit

When applying for loans with bad credit, there are several important factors to consider to increase your chances of approval and secure favorable terms.

Importance of credit score

Your credit score plays a crucial role in determining your eligibility for a loan and the interest rate you may be offered. Lenders use your credit score to assess your creditworthiness and ability to repay the loan.

Impact of income and employment history

Having a stable income and a steady employment history can positively impact your loan approval chances. Lenders want to ensure that you have the means to repay the loan on time.

Tips for improving credit score

– Paying bills on time

– Keeping credit card balances low

– Checking your credit report for errors

– Avoiding opening new credit accounts

Comparing interest rates from different lenders

It is important to shop around and compare interest rates from various lenders to find the best option that suits your financial situation. Lower interest rates can save you money in the long run.

Consider getting a co-signer

If your credit is not strong enough to qualify for a loan on your own, having a co-signer with good credit can increase your chances of approval. Keep in mind that both parties are equally responsible for repaying the loan.

Understanding loan terms and conditions

Before signing any loan agreement, make sure to carefully read and understand the terms and conditions. Pay close attention to interest rates, fees, repayment terms, and any penalties for late payments.

Creating a detailed budget

It is essential to create a detailed budget that outlines your income and expenses to show how you will repay the loan. This demonstrates to lenders that you have a clear repayment plan in place.

Exploring alternative loan options

If traditional lenders are not willing to approve your loan application, consider alternative options such as secured loans or peer-to-peer lending. These alternatives may offer more flexible terms for borrowers with bad credit.

Benefits of loans for bad credit

Despite having bad credit, there are several advantages to taking out a loan that can help individuals rebuild their credit and improve their financial situation.

Helping rebuild credit

One of the main benefits of loans for bad credit is that they provide an opportunity for individuals to demonstrate their ability to manage debt responsibly. By making timely payments on a bad credit loan, borrowers can gradually improve their credit score over time.

Access to funds in emergencies

Bad credit loans can be a lifeline for individuals facing unexpected expenses or emergencies. These loans provide access to much-needed funds when traditional lenders may not be an option due to poor credit history.

Flexible repayment terms

Many bad credit loans offer flexible repayment terms, allowing borrowers to tailor the loan to their specific financial situation. This can help individuals manage their debt more effectively and avoid falling further into financial hardship.

Success stories

There are numerous success stories of individuals who have benefited from bad credit loans. By taking out a loan and responsibly managing their debt, many people have been able to improve their credit score, secure better loan terms in the future, and achieve their financial goals.

Risks associated with loans for bad credit

When considering loans for bad credit, it is important to be aware of the potential risks and drawbacks that come with them. These risks can have significant implications on your financial well-being if not managed properly. In this section, we will discuss the impact of high interest rates on bad credit loans and provide tips on how to minimize the risks associated with borrowing with bad credit.

Impact of high interest rates on bad credit loans

Bad credit loans typically come with higher interest rates compared to loans for borrowers with good credit scores. This means that you will end up paying more in interest over the life of the loan, making it more expensive in the long run. The high interest rates can also make it challenging to keep up with monthly payments, leading to a cycle of debt if not managed carefully.

Tips on managing risks when borrowing with bad credit

- Avoid borrowing more than you can afford to repay: Before taking out a loan, carefully assess your financial situation and ensure that you can comfortably make the monthly payments.

- Shop around for the best terms: Compare offers from different lenders to find the most favorable terms, including interest rates and repayment options.

- Consider alternatives to traditional loans: Explore other options such as credit unions, peer-to-peer lending, or secured loans that may offer more favorable terms for borrowers with bad credit.

- Improve your credit score: Work on improving your credit score over time to qualify for better loan terms in the future. This may involve making timely payments, reducing debt, and correcting any errors on your credit report.

- Seek financial counseling: If you are struggling with debt or managing your finances, consider seeking help from a financial counselor who can provide guidance on how to improve your financial situation and avoid falling into further debt.

How to find reputable lenders offering loans for bad credit

When looking for reputable lenders that offer loans for bad credit, there are several steps you can take to ensure you are making a well-informed decision. Here are some tips to help you find the right lender for your needs:

Research Online Platforms

Start your search by exploring online platforms such as financial comparison websites, forums, and review sites. These platforms can provide you with a list of reputable lenders that specialize in offering loans to individuals with bad credit.

Accreditation and Recognition

Prioritize lenders that are accredited by organizations like the Better Business Bureau or recognized financial regulatory bodies. This accreditation can provide you with the assurance that the lender meets certain standards of professionalism and reliability.

Local Credit Unions and Community Banks

Consider reaching out to local credit unions or community banks as they may offer more personalized and flexible options for bad credit loans. These institutions often have a focus on community support and may be more willing to work with individuals with less-than-perfect credit.

Comparison and Evaluation

When comparing different lenders, pay close attention to details such as interest rates, repayment terms, fees, and customer reviews. By evaluating these factors, you can make a more informed decision about which lender is the best fit for your financial situation.

Utilize Online Tools

Create a table comparing at least three different lenders, including details such as APR, loan amounts, eligibility requirements, and customer service ratings. Additionally, make use of online loan calculators to estimate monthly payments and total repayment amounts based on different loan offers.

Watch for Red Flags

Be cautious of lenders that guarantee approval or ask for upfront fees before providing any loan details. Look out for red flags such as high-pressure sales tactics, unclear terms and conditions, and unusually high interest rates that may indicate predatory lending practices.

Strategies for improving credit score while repaying bad credit loans

Improving your credit score while repaying bad credit loans is essential for your financial health and future borrowing opportunities. Here are some strategies to help you achieve this:

Making Timely Payments

One of the most important factors in improving your credit score is making timely payments on your loans. Set up automatic payments or reminders to ensure you never miss a due date.

Credit Utilization and Credit Score Improvement

Monitor your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. Keeping this ratio low can positively impact your credit score. Aim to keep your credit utilization below 30%.

Creating a Budget to Manage Loan Repayments

Develop a budget that outlines your income and expenses, including loan repayments. By managing your finances effectively, you can ensure that you have enough funds to make your loan payments on time each month.

Alternatives to traditional loans for individuals with bad credit

When individuals with bad credit are unable to secure traditional loans, there are alternative financing options available to help meet their financial needs. These alternatives can provide access to funds even with a low credit score, offering a lifeline to those who may otherwise be turned away by traditional lenders.

Peer-to-Peer Lending and Credit Unions

Peer-to-peer lending platforms connect borrowers directly with individual investors willing to fund their loans. These platforms often have more flexible eligibility criteria than traditional banks, making them a viable option for individuals with bad credit. Credit unions, on the other hand, are non-profit organizations that offer loans to their members at competitive rates, regardless of credit history.

Secured Loans

Secured loans require borrowers to pledge collateral, such as a car or property, to secure the loan. This reduces the risk for lenders, making it easier for individuals with bad credit to qualify for a loan. While defaulting on a secured loan can result in the loss of the collateral, these loans can be a valuable option for those in need of funds.

Government Programs

Various government programs provide financial assistance to individuals with bad credit, helping them access loans or grants for specific purposes. For example, the Small Business Administration offers loans to entrepreneurs with less-than-perfect credit, while the Department of Housing and Urban Development provides housing assistance to low-income individuals.

Understanding the impact of bad credit on loan approval

When it comes to applying for loans with bad credit, it’s essential to understand how your credit score can impact the approval process. Lenders use your credit score as a way to assess your creditworthiness and ability to repay the loan. Having bad credit can make it more challenging to get approved for a loan, but it doesn’t mean it’s impossible.

How bad credit affects loan approval

- Lenders may see bad credit as a red flag, indicating a higher risk of defaulting on the loan.

- Bad credit can lead to higher interest rates, as lenders may compensate for the increased risk by charging more.

- Some lenders may require additional collateral or a co-signer to approve a loan for bad credit applicants.

Tips for negotiating terms and conditions of bad credit loans

When dealing with bad credit loans, negotiating favorable terms and conditions can make a significant difference in managing your financial situation effectively. Understanding how to approach these negotiations can help you secure a better deal and improve your overall financial health.

Strategies for negotiating lower interest rates on bad credit loans

- Do your research: Before approaching a lender, research current interest rates for bad credit loans to have a clear understanding of what is reasonable.

- Highlight your strengths: Emphasize any positive aspects of your financial situation, such as stable employment or a history of timely payments, to show lenders that you are a reliable borrower.

- Negotiate based on competition: If you receive offers from multiple lenders, use this as leverage to negotiate lower interest rates or better terms.

Importance of reading and understanding the terms and conditions of the loan agreement

It is crucial to carefully review the terms and conditions of a bad credit loan agreement to avoid any surprises or hidden fees. Understanding the fine print can help you make informed decisions and protect yourself from unfavorable terms.

Tips on how to request modifications to loan terms based on individual circumstances

- Communicate openly: Discuss your financial situation with the lender and explain any challenges you may face in meeting the original terms of the loan.

- Propose alternatives: Suggest modifications that could make repayment more manageable, such as extending the loan term or adjusting the monthly payment amount.

- Seek professional advice: Consider consulting with a financial advisor or credit counselor to help you negotiate more effectively and explore all available options.

Common myths and misconceptions about loans for bad credit

When it comes to loans for bad credit, there are several myths and misconceptions that can prevent individuals from exploring their options. By debunking these common myths, we can provide accurate information to help borrowers make informed decisions.

Top 5 common myths about bad credit loans:

- Myth 1: Bad credit loans are always predatory and come with exorbitant interest rates.

- Myth 2: It is impossible to get approved for a loan with bad credit.

- Myth 3: Applying for a bad credit loan will further damage your credit score.

- Myth 4: All lenders offering bad credit loans are scams or untrustworthy.

- Myth 5: Improving your credit score is impossible while repaying a bad credit loan.

Let’s dive into each myth to debunk misconceptions and provide clarity for individuals seeking loans with bad credit.

Myth 1: Bad credit loans are always predatory and come with exorbitant interest rates.

It is a common misconception that all bad credit loans carry unreasonable interest rates. While some lenders may take advantage of borrowers with poor credit, there are reputable institutions that offer fair terms and rates based on individual circumstances.

Myth 2: It is impossible to get approved for a loan with bad credit.

Contrary to popular belief, individuals with bad credit can still qualify for loans. Lenders specializing in bad credit loans consider various factors beyond credit scores, such as income and employment history, to assess eligibility.

Myth 3: Applying for a bad credit loan will further damage your credit score.

While applying for multiple loans within a short period can negatively impact your credit score, a single application for a bad credit loan is unlikely to cause significant harm. In fact, responsible repayment of a bad credit loan can help improve your credit over time.

Myth 4: All lenders offering bad credit loans are scams or untrustworthy.

While there are predatory lenders in the market, not all institutions offering bad credit loans are scams. It is essential to research and identify reputable lenders with transparent terms and positive customer reviews to avoid falling victim to fraudulent practices.

Myth 5: Improving your credit score is impossible while repaying a bad credit loan.

On the contrary, making timely payments on a bad credit loan can demonstrate positive financial behavior and contribute to rebuilding your credit score. By responsibly managing your loan, you can work towards improving your creditworthiness for future borrowing needs.

Legal rights and protections for individuals with bad credit

When it comes to individuals with bad credit applying for loans, there are specific legal rights and protections in place to safeguard their interests and ensure fair treatment by lenders.

Consumer Protection Laws

Consumer protection laws play a crucial role in safeguarding the rights of individuals with bad credit. These laws regulate the lending industry and protect borrowers from unfair practices such as discrimination based on credit history, excessive fees, and deceptive lending practices.

- Consumers have the right to access their credit reports for free once a year and dispute any errors they find.

- Lenders are required to provide clear and transparent information about loan terms, interest rates, and fees to borrowers.

- If individuals feel they have been treated unfairly by a lender, they can seek assistance from consumer protection agencies or legal counsel to address the issue.

Consequences for Violating Borrowers’ Rights

Lenders who violate the rights of borrowers with bad credit can face legal consequences such as fines, penalties, and even license revocation. It is essential for lenders to adhere to the laws and regulations governing lending practices to avoid such repercussions.

Role of Credit Counseling Agencies

Credit counseling agencies play a vital role in assisting individuals with bad credit in managing their finances effectively. These agencies provide financial education, budgeting assistance, and debt management plans to help borrowers improve their credit scores and overall financial health.

- Credit counseling agencies can negotiate with lenders on behalf of borrowers to establish repayment plans or reduce interest rates.

- They offer personalized guidance on budgeting, saving, and debt repayment strategies to help individuals with bad credit regain financial stability.

Predatory Lending Practices

Individuals with bad credit should be aware of predatory lending practices that target vulnerable borrowers and can lead to further financial distress. Examples of predatory lending practices include:

- Excessive interest rates

- Unnecessary insurance or add-on products

- Loan flipping or frequent refinancing

- Hidden fees or charges

It is essential for individuals with bad credit to be cautious and informed when seeking loans to avoid falling victim to predatory lenders.

Impact of economic conditions on availability of loans for bad credit

In times of economic uncertainty or downturns, the availability of loans for individuals with bad credit can be significantly affected. Lenders may become more cautious and stringent in their approval processes, making it challenging for those with poor credit scores to secure financing.

Loan Approval Trends During Economic Fluctuations

During economic fluctuations, loan approval rates for individuals with bad credit tend to decrease. Lenders become more risk-averse and may tighten their lending criteria, leading to higher rejection rates for applicants with poor credit histories.

- Financial institutions may reduce their lending activities during economic crises, resulting in limited options for individuals with bad credit.

- Online lenders, on the other hand, may be more flexible in their lending criteria and may still offer loans to individuals with bad credit, albeit at higher interest rates.

Role of Credit Scores in Loan Approval

Credit scores and credit history play a crucial role in determining loan approval during economic instability. Individuals with bad credit may find it more challenging to secure loans, as lenders perceive them as higher risks during uncertain economic times.

- Improving credit scores by making timely payments and reducing debt levels can increase the chances of loan approval, even in economic downturns.

- Building a positive credit history by responsibly managing credit accounts can also enhance creditworthiness and improve loan approval prospects.

Strategies for Securing Loans in Challenging Economic Conditions

To navigate challenging economic conditions and secure loans with bad credit, individuals can consider the following strategies:

- Exploring alternative lenders such as online platforms that may have more lenient approval criteria.

- Seeking co-signers with good credit scores to strengthen loan applications.

- Providing collateral or assets to secure the loan and mitigate lender risk.

Case studies of successful loan applications with bad credit

In this section, we will explore real-life examples of individuals who were able to secure loans despite having bad credit. We will analyze the strategies they employed and the key takeaways for others in similar situations.

Case Study 1: Personal Loan Approval

- Individual: John Doe

- Credit Score Before: 550

- Credit Score After: 620

- Loan Type: Personal Loan

- Key Factors: John demonstrated a steady income, stable employment history, and a detailed repayment plan.

Case Study 2: Secured Loan Approval

- Individual: Jane Smith

- Credit Score Before: 500

- Credit Score After: 590

- Loan Type: Secured Loan

- Key Factors: Jane offered collateral, such as a vehicle, which reduced the lender’s risk.

Key Takeaways

- Stable income and employment history can increase approval chances.

- Offering collateral can mitigate the risk for lenders.

- Having a clear repayment plan is crucial for loan approval.

Future outlook for the bad credit lending industry

The bad credit lending industry is expected to undergo significant changes in the future, influenced by various factors such as technological advancements, regulatory developments, and evolving consumer needs. Lenders and borrowers alike must be prepared to adapt to these upcoming shifts to navigate the changing landscape effectively.

Impact of Emerging Technologies

Emerging technologies like blockchain and artificial intelligence (AI) are poised to revolutionize the bad credit lending sector. These innovations can streamline the loan application process, enhance risk assessment capabilities, and improve overall efficiency. Lenders leveraging these technologies may be able to offer more competitive rates and tailored solutions to borrowers with bad credit.

Alternative Credit Scoring Methods

The future of bad credit lending may see a greater reliance on alternative credit scoring methods beyond traditional credit scores. Factors such as employment history, income stability, and payment behavior could play a more significant role in assessing creditworthiness. This shift could open up opportunities for individuals with limited credit histories or past financial challenges to access loans.

Regulatory Environment and Regional Variances

Different regions may have varying regulatory frameworks governing bad credit lending, impacting the types of loans available and the terms and conditions offered to borrowers. Lenders operating in multiple jurisdictions must navigate these complexities to ensure compliance while meeting the needs of underserved borrowers. Adapting to evolving regulations and consumer protections will be crucial for the sustainability of bad credit lending operations.

Risk Mitigation Strategies for Lenders

As the bad credit lending landscape evolves, lenders must implement robust risk mitigation strategies to protect their interests and maintain financial stability. This may involve enhancing underwriting processes, diversifying loan portfolios, and incorporating data analytics to assess borrower risk more accurately. By proactively managing risks, lenders can continue to provide access to credit for individuals with bad credit while safeguarding their financial health.

Last Word

Exploring the realm of loans for bad credit unveils a landscape filled with diverse options, risks, and rewards. By understanding the nuances of this financial avenue, individuals can navigate the complexities of bad credit with confidence and strategic foresight.