Instant Loans: Finding Quick Financial Solutions

Instant loans provide a fast and convenient way to access funds when needed urgently. From understanding the various types to navigating the application process, this guide covers everything you need to know about instant loans.

Whether you’re facing a financial emergency or looking to cover unexpected expenses, instant loans can offer the financial support you need with minimal hassle.

Types of Instant Loans

When it comes to instant loans, there are different types available to cater to various financial needs. Each type has specific eligibility criteria, application processes, interest rates, and pros and cons. Let’s explore the different types of instant loans:

Payday Loans

Payday loans are short-term, high-interest loans that are typically due on the borrower’s next payday. The eligibility criteria usually require proof of income and a checking account. The application process involves filling out a simple form online or in-person, and approval can be quick.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Eligibility criteria may include credit score, income, and employment status. The application process involves submitting an application form, documentation, and undergoing a credit check.

Installment Loans

Installment loans allow borrowers to repay the loan amount in fixed monthly installments over a period of time. These loans can be secured or unsecured, with eligibility criteria based on credit history, income, and debt-to-income ratio. The application process may involve a more detailed review of financial documents and credit history.

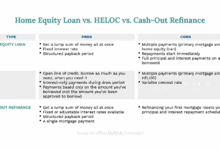

Comparison Table

| Loan Type | Pros | Cons |

|---|---|---|

| Payday Loans | Quick approval, no credit check | High interest rates, short repayment period |

| Personal Loans | Flexible use, lower interest rates | Approval may take longer, credit check required |

| Installment Loans | Structured repayment, larger loan amounts | Interest rates may vary, longer approval process |

Choosing the Right Instant Loan

When selecting an instant loan, consider your financial needs, repayment ability, and the terms of the loan. It’s essential to compare interest rates, fees, and repayment terms to find the most suitable option. Additionally, make sure to review the eligibility criteria to ensure you qualify for the loan type you choose.

Pros and Cons of Instant Loans

Instant loans offer quick access to funds in times of financial need, but they also come with their own set of advantages and disadvantages. It is essential to weigh these factors carefully before deciding to take out an instant loan.

Advantages of Instant Loans

- Immediate Access to Funds: Instant loans provide fast approval and disbursement of funds, making them ideal for emergencies.

- No Credit Check: Some instant loan providers do not require a credit check, making it easier for individuals with poor credit scores to qualify.

- Convenience: The online application process for instant loans is quick and simple, allowing borrowers to apply from the comfort of their homes.

- Flexible Repayment Options: Instant loans often come with flexible repayment terms, allowing borrowers to choose a repayment schedule that suits their financial situation.

Drawbacks of Instant Loans

- High Interest Rates: Instant loans typically carry higher interest rates compared to traditional loans, leading to increased overall borrowing costs.

- Short Repayment Periods: Some instant loans have short repayment periods, which can put pressure on borrowers to repay the loan quickly.

- Risk of Debt Cycle: If not managed properly, taking out multiple instant loans can lead to a cycle of debt, making it challenging to break free from financial burdens.

Tips to Maximize Benefits and Minimize Disadvantages

- Borrow Only What You Need: Avoid borrowing more than necessary to reduce the overall cost of the loan.

- Compare Offers: Shop around and compare different instant loan providers to find the best terms and interest rates.

- Create a Repayment Plan: Have a clear repayment plan in place to ensure timely repayment and avoid falling into a debt trap.

Real-life Examples

Instant loans have helped individuals cover unexpected medical expenses, car repairs, or other urgent financial needs. However, some borrowers have faced challenges in repaying instant loans, leading to a cycle of debt and financial stress. It is crucial to use instant loans responsibly and understand the terms and conditions before borrowing.

Application Process for Instant Loans

When applying for an instant loan online, it is crucial to follow a step-by-step process to ensure a smooth and efficient experience. Here, we will outline the typical steps involved in applying for an instant loan, the documentation required, the timeline from application to approval, and how to increase your chances of approval.

Step-by-Step Process

- Start by choosing a reputable lender that offers instant loans online.

- Visit the lender’s website or download their mobile app to begin the application process.

- Fill out the online application form with accurate personal and financial information.

- Upload any required documentation, such as ID proof, income proof, and bank statements.

- Submit your application and wait for the lender to review your information.

- If approved, carefully review the loan terms and conditions before accepting the offer.

- Once you accept the offer, the funds will be disbursed to your bank account within a specified timeline.

Documentation and Information Required

- Personal identification documents (such as passport or driver’s license).

- Proof of income (pay stubs, bank statements, or tax returns).

- Verification of employment or income source.

- Bank account details for fund disbursement.

Timeline from Application to Disbursement

The timeline from application to disbursement of funds for instant loans can vary depending on the lender and your individual circumstances. However, in general, you can expect to receive the funds in your bank account within 1 to 3 business days after approval.

Tips to Improve Approval Chances

- Maintain a good credit score and credit history.

- Provide accurate and up-to-date information in your application.

- Ensure you meet the minimum income requirements set by the lender.

- Consider adding a co-signer with a strong credit profile to increase your chances of approval.

Interest Rates and Fees

Interest rates and fees play a crucial role in determining the overall cost of instant loans. Understanding how these are calculated and comparing offerings from different lenders can help borrowers make informed decisions.

Interest Rates Calculation

Interest rates for instant loans are typically calculated based on the principal amount borrowed, the repayment term, and the Annual Percentage Rate (APR). The APR includes not only the interest rate but also any fees or charges associated with the loan. It is essential to consider the APR when comparing loan offers as it provides a more accurate representation of the total cost of borrowing.

Common Fees

- Late Payment Fees: Charged when borrowers fail to make payments on time.

- Processing Fees: Fees for processing the loan application.

- Early Repayment Fees: Charged when borrowers pay off the loan before the agreed-upon term.

Finding the Best Rates and Fees

When looking for instant loans, consider factors such as your credit score, the loan amount you need, and shop around to compare offers from different lenders. To secure the best rates and lowest fees, aim to improve your credit score, borrow only what you need, and carefully review the terms and conditions of each loan offer.

Comparison of Lenders

| Lender | Interest Rate | Fees | Unique Features |

|---|---|---|---|

| Lender A | 8% | Processing fee of $50 | Offers flexible repayment options |

| Lender B | 10% | Late payment fee of $25 | Quick approval process |

| Lender C | 6% | No processing fees | Lower APR for repeat customers |

Eligibility Criteria for Instant Loans

When applying for instant loans, it is crucial to meet certain eligibility criteria to increase the likelihood of approval. Lenders have specific requirements that borrowers must fulfill in order to qualify for these quick funding options.

Typical Eligibility Requirements

- Minimum age of 18 years or older.

- Valid identification and proof of residency.

- Stable income source or employment status.

- Satisfactory credit history or credit score.

Factors Impacting Eligibility

- Credit Score: A higher credit score often leads to better loan terms and higher approval chances.

- Income: Lenders evaluate your income to ensure you can repay the loan amount.

- Employment Status: Having a stable job or a consistent source of income is crucial.

Tips to Meet Eligibility Criteria

- Work on improving your credit score by making timely payments and reducing outstanding debts.

- Ensure you have a steady income by providing proof of employment or any other income sources.

- Review and correct any errors on your credit report to present an accurate financial picture to lenders.

Alternative Options for Individuals with Low Eligibility

If you do not meet the traditional eligibility requirements for instant loans, consider alternative options such as:

- Secured loans with collateral.

- Co-signer loans with a guarantor.

- Payday alternative loans (PALs) from credit unions.

Minimum Credit Score Ranges by Lenders

| Lender | Minimum Credit Score |

|---|---|

| ABC Bank | 650 |

| XYZ Online Lender | 600 |

Importance of Income and Employment History

Having a stable income and employment history demonstrates to lenders that you have the means to repay the loan. It adds a layer of security for them and increases your chances of approval.

Improving Credit Score for Loan Approval

To quickly improve your credit score, focus on:

- Reducing credit card balances.

- Making timely payments on all debts.

- Avoiding opening new credit accounts unnecessarily.

Comparison: Traditional Banks vs. Online Lenders

When it comes to eligibility requirements for instant loans, online lenders are often more lenient compared to traditional banks. Online lenders may consider alternative data points for approval, making it easier for individuals with less-than-perfect credit to qualify for a loan.

Repayment Options for Instant Loans

When it comes to repaying instant loans, borrowers have several options to choose from depending on their financial situation and preferences. It is crucial to understand the different repayment options available and their implications to ensure timely repayments and maintain a good credit score.

Fixed Monthly Payments

One common repayment option for instant loans is fixed monthly payments, where borrowers pay a set amount each month until the loan is fully repaid. This option provides predictability and makes budgeting easier for borrowers.

Bi-Weekly Payments

Another repayment option is bi-weekly payments, where borrowers make payments every two weeks instead of once a month. This can help borrowers pay off the loan faster and reduce the overall interest paid over the loan term.

Balloon Payments

Some instant loans may offer balloon payments, where borrowers make smaller monthly payments throughout the loan term and a larger final payment at the end. While this option may reduce monthly payment amounts, borrowers need to be prepared for the larger final payment.

Importance of Timely Repayments

Timely repayments are crucial to avoid negative consequences such as late fees, additional interest, and damage to your credit score. Defaulting on instant loans can lead to collection actions and legal consequences, impacting your financial stability in the long run.

Strategies for Managing Loan Repayments

- Set up automatic payments to ensure you never miss a payment.

- Create a budget plan to allocate funds for loan repayments each month.

- Priority loan payments to ensure they are paid before other expenses.

Negotiating Repayment Terms

If you are facing financial difficulties, consider negotiating repayment terms with your lender. Requesting a loan modification, exploring debt consolidation options, or seeking help from credit counseling services can help you manage your repayments effectively.

Impact on Credit History

Successful repayment of instant loans can positively impact your credit history by demonstrating responsible borrowing behavior. It is essential to make timely payments and fully repay the loan to rebuild credit and improve your financial standing.

Impact of Instant Loans on Credit Score

Instant loans can have a significant impact on an individual’s credit score, both positively and negatively. It is essential to understand how these loans can affect creditworthiness and financial health.

Taking out an instant loan and making timely repayments can actually help improve one’s credit score over time. This is because regular and on-time payments demonstrate financial responsibility and reliability to lenders, which can boost creditworthiness.

Positive Impact of Timely Repayments

- Timely repayments on instant loans can reflect positively on credit reports, showcasing responsible borrowing behavior.

- Consistent payments can help build a positive credit history, which is crucial for future loan approvals and better interest rates.

- Improving credit scores through timely repayments can open up opportunities for better financial products and lower borrowing costs.

Using Instant Loans to Build Credit History

- One way to use instant loans to build or improve credit history is to borrow only what you need and can afford to repay.

- Make sure to repay the loan on time and in full to demonstrate creditworthiness and responsible borrowing habits.

- Regularly monitoring your credit report can help you track your progress and identify any errors that may be affecting your score.

Negative Impact of Defaulting on Instant Loans

- Defaulting on instant loans can severely damage credit scores, making it harder to qualify for future credit or loans.

- Missed payments and defaults can stay on credit reports for years, impacting creditworthiness and financial opportunities.

- A damaged credit score due to defaulting on loans can lead to higher interest rates, limited borrowing options, and financial stress.

Alternatives to Instant Loans

When instant loans are not a viable option, there are alternative ways to secure the necessary funds. These alternatives include borrowing from friends or family, credit unions, and peer-to-peer lending platforms. Each option has its own advantages and disadvantages, so it’s essential to consider individual financial circumstances before making a decision.

Borrowing from Friends or Family

One alternative to instant loans is borrowing money from friends or family members. This option can be beneficial as it may come with lower or no interest rates. However, it can strain personal relationships if the borrowed amount is not repaid on time.

Credit Unions

Credit unions are another alternative to instant loans. They often offer lower interest rates compared to traditional banks and are more flexible with repayment terms. However, membership criteria may apply, and the application process can be more involved.

Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms connect borrowers with individual investors willing to lend money. These platforms typically offer competitive interest rates and repayment terms. However, borrowers may need a good credit score to qualify for a loan.

Comparison Table

| Alternatives | Interest Rates | Repayment Terms | Eligibility Criteria |

|---|---|---|---|

| Borrowing from Friends or Family | Varies | Flexible | N/A |

| Credit Unions | Lower rates | Flexible | Membership criteria |

| Peer-to-Peer Lending Platforms | Competitive | Varies | Good credit score |

Approaching Friends or Family for a Loan

When seeking a loan from friends or family, it’s important to be transparent about the purpose of the loan, the repayment plan, and any expectations involved. Clearly outlining these details can help avoid misunderstandings and maintain healthy relationships.

Application Process for Credit Unions and Peer-to-Peer Lending Platforms

Applying for a loan from a credit union typically involves becoming a member, completing an application, and providing necessary documentation. Peer-to-peer lending platforms require creating a profile, submitting a loan request, and undergoing a credit check.

Regulations and Consumer Protections

In the realm of instant loans, it is crucial to understand the regulatory framework and consumer protections in place to safeguard borrowers from potential risks and predatory lending practices.

Regulations Governing Instant Loans

- In the United States, instant loans are regulated at both the federal and state levels. The Truth in Lending Act (TILA) requires lenders to disclose key terms and costs of the loan to borrowers.

- In the United Kingdom, the Financial Conduct Authority (FCA) regulates instant loans through the Consumer Credit Act, which sets rules for credit agreements and protects consumers from unfair practices.

- In Australia, instant loans fall under the jurisdiction of the Australian Securities and Investments Commission (ASIC), which enforces responsible lending obligations on financial institutions.

Consumer Protection Measures

- Consumer protection measures include the right to information disclosure, fair lending practices, and the establishment of cooling-off periods to allow borrowers to reconsider their decision without penalty.

- Borrowers should be wary of predatory lenders who engage in deceptive practices, such as offering loans with exorbitant interest rates or hidden fees. It is essential to research and identify reputable lenders to avoid falling victim to scams.

Interest Rate Caps in Different Countries

- In the US, some states have imposed interest rate caps on instant loans to protect consumers from high-cost borrowing. For example, the state of New York has a usury cap of 25% APR for most loans.

- In the UK, the FCA has set a cap on interest rates for high-cost short-term credit, limiting the total cost of borrowing to 100% of the original loan amount to prevent borrowers from falling into a cycle of debt.

- Australia has also implemented interest rate caps on instant loans to ensure that borrowers are not subjected to unfair and exploitative lending practices.

Filing Complaints and Reporting Abusive Lending Practices

- Borrowers who encounter abusive lending practices can file complaints with regulatory authorities such as the Consumer Financial Protection Bureau (CFPB) in the US, the Financial Ombudsman Service in the UK, and the Australian Financial Complaints Authority (AFCA) in Australia.

- It is important to document any evidence of predatory lending, such as misleading information or excessive fees, and submit a detailed complaint outlining the violations.

Role of Credit Bureaus and Prosecution of Predatory Lenders

- Credit bureaus play a crucial role in regulating instant loans by providing credit reports to lenders to assess borrowers’ creditworthiness. They also help detect fraudulent activities and protect consumers from identity theft.

- A successful prosecution of a predatory lending institution can lead to significant changes in consumer protection policies, setting a precedent for holding lenders accountable for their actions and deterring future misconduct.

Instant Loans for Emergency Situations

In times of unexpected emergencies, instant loans can serve as a crucial financial lifeline for individuals facing urgent financial needs. These loans are designed to provide quick access to funds, offering a convenient solution to cover unforeseen expenses without the lengthy approval process associated with traditional bank loans.

Role of Instant Loans in Emergencies

Instant loans play a vital role in emergencies by offering immediate financial assistance to individuals in need. Whether it’s a medical emergency, car repair, or unexpected home repairs, these loans can help bridge the gap between the urgent need for funds and the next paycheck.

- Instant loans provide quick access to funds, typically within 24 hours, allowing borrowers to address emergencies promptly.

- These loans require minimal documentation and have straightforward application processes, making them ideal for urgent situations.

- Instant loans can help individuals avoid late payment fees, penalties, or other financial repercussions resulting from delayed payments.

Tips for Responsible Use of Instant Loans in Emergencies

When utilizing instant loans during emergencies, it’s essential to use them responsibly to avoid falling into a cycle of debt. Here are some tips to consider:

- Only borrow the amount you need to cover the emergency expenses, avoiding unnecessary additional funds.

- Ensure you understand the terms and conditions of the loan, including the repayment schedule and associated fees.

- Create a repayment plan to ensure timely repayment of the loan to avoid accruing high interest rates or late fees.

Common Emergencies Suitable for Instant Loans

Instant loans can be a suitable solution for various emergencies, including:

- Medical emergencies

- Car repairs

- Home repairs

- Unexpected travel expenses

Alternatives to Instant Loans for Emergency Funding

While instant loans can provide quick access to funds in emergencies, it’s essential to consider alternative options, such as:

- Emergency savings fund

- Personal line of credit

- Borrowing from family or friends

Key Factors to Consider Before Applying for an Instant Loan

Before applying for an instant loan, consider the following factors:

- Interest rates and fees associated with the loan

- Repayment terms and options

- Credibility and reputation of the lender

Comparison of Instant Loans vs. Traditional Bank Loans

| Instant Loans | Traditional Bank Loans |

|---|---|

| Quick approval and disbursement | Lengthy approval process |

| Higher interest rates | Lower interest rates |

| Minimal documentation required | Detailed documentation and credit checks |

Assessing Credibility of Instant Loan Providers – Step-by-Step Guide

When choosing an instant loan provider, follow these steps to assess their credibility:

- Check online reviews and ratings of the lender

- Verify the lender’s license and accreditation

- Review the terms and conditions of the loan carefully

Evaluation Checklist for Borrowers Before Taking Out an Instant Loan

Before taking out an instant loan, borrowers should evaluate their repayment capabilities by considering:

- Monthly income and expenses

- Existing debts and financial commitments

- Emergency fund availability

Instant Loans for Small Businesses

Instant loans can be a valuable tool for small businesses in need of quick financing to cover expenses, invest in growth opportunities, or manage cash flow. These loans provide immediate access to funds without the lengthy approval processes associated with traditional bank loans, making them ideal for small businesses facing urgent financial needs.

Types of Instant Loans for Small Businesses

- Online Business Loans: Offered by online lenders with quick approval processes and funding timelines.

- Merchant Cash Advances: Advance on future credit card sales, with repayments tied to daily card transactions.

- Invoice Financing: Allows businesses to borrow against outstanding invoices to improve cash flow.

Tips for Small Business Owners

- Use instant loans strategically to invest in revenue-generating activities like marketing or equipment upgrades.

- Ensure you can comfortably afford the loan repayments without straining your cash flow.

- Compare offers from different lenders to secure the best terms and rates for your business.

Success Stories

“ABC Bakery was able to expand its operations and reach new customers by using an instant loan to invest in a larger production facility.”

“XYZ Consulting saw a significant increase in revenue after securing an instant loan to launch a new service line.”

Instant Loans and Financial Planning

Instant loans play a crucial role in overall financial planning by providing quick access to funds during emergencies or unexpected expenses. However, incorporating instant loans into a comprehensive financial strategy requires careful consideration to ensure long-term financial stability.

Tips for Incorporating Instant Loans into Financial Planning

- Only use instant loans for essential and urgent needs, not for discretionary expenses.

- Calculate the total cost of borrowing, including interest rates and fees, to determine affordability.

- Create a repayment plan to avoid falling into a cycle of debt and prioritize paying off the loan as soon as possible.

- Monitor your credit score regularly and aim to improve it to access better loan options in the future.

Examples of When to Consider Instant Loans in Financial Planning

- Medical emergencies that require immediate treatment but exceed your savings.

- Unexpected car repairs essential for commuting to work or fulfilling other responsibilities.

- Temporary cash flow issues in small businesses that can be resolved with quick funding.

Long-Term Implications of Using Instant Loans on Financial Stability

Instant loans can provide short-term relief but may lead to long-term financial implications if not managed effectively. These implications include:

- Accumulation of high-interest debt that can strain finances and lead to a cycle of borrowing.

- Potential damage to credit score if loan repayments are missed, limiting access to future credit at favorable terms.

- Reduced savings and investment opportunities due to loan repayments taking a significant portion of income.

Instant Loans and Personal Finance Management

Instant loans can have a significant impact on an individual’s financial health, both positively and negatively. It is crucial to understand how to effectively manage instant loans within the broader context of personal finance to avoid falling into debt traps and financial instability.

Benefits of Integrating Instant Loans

- Instant loans can provide quick access to funds in times of emergencies, helping individuals cover unexpected expenses without disrupting their overall financial plan.

- When used strategically, instant loans can improve credit scores by demonstrating responsible borrowing behavior and timely repayments.

- Instant loans can also serve as a valuable tool for managing cash flow gaps or seizing time-sensitive opportunities for investments or purchases.

Risks and Pitfalls to Avoid

- Excessive reliance on instant loans can lead to a debt spiral, with high-interest rates and fees exacerbating financial burdens over time.

- Failing to repay instant loans on time can result in additional penalties, damaging credit scores and limiting access to future credit options.

- Impulsive borrowing without a clear repayment plan can strain personal finances and create a cycle of borrowing to cover previous debts.

Strategies for Effective Personal Finance Management

- Set a clear budget and financial goals to ensure that instant loans are used purposefully and within affordable limits.

- Compare different instant loan providers to find the most favorable terms and interest rates that align with your financial situation.

- Regularly monitor your credit report and financial statements to track the impact of instant loans on your overall financial health.

Making Informed Decisions

- Before taking out an instant loan, carefully assess the need, repayment terms, and total cost to determine if it aligns with your financial goals.

- Seek financial advice from professionals or credit counseling services to gain insights into managing instant loans effectively and improving overall financial well-being.

- Be cautious of predatory lenders and offers that seem too good to be true, as they may lead to financial distress and long-term consequences.

Conclusion

In conclusion, instant loans can be a valuable tool in managing financial challenges effectively. By weighing the pros and cons, understanding the application process, and exploring alternative options, individuals can make informed decisions when considering instant loans.