Home Equity Loan Rates: A Comprehensive Guide To Understanding Rates And Options

When it comes to financial decisions, understanding home equity loan rates is crucial. From different types of loans to factors influencing rates, this guide delves deep into everything you need to know.

Explaining the Concept of Artificial Intelligence

Artificial Intelligence (AI) refers to the simulation of human intelligence processes by machines, especially computer systems. These processes include learning, reasoning, problem-solving, perception, and language understanding. AI aims to create systems that can perform tasks that typically require human intelligence.

Understanding Machine Learning Algorithms

Machine learning algorithms are a subset of AI that enable machines to learn from data without being explicitly programmed. These algorithms are designed to improve their performance over time as they are exposed to more data. They can be categorized into supervised and unsupervised learning algorithms.

- Supervised Learning: In supervised learning, the algorithm is trained on a labeled dataset, where the correct output is provided. The algorithm learns to map input to output based on the training data. Examples include linear regression, decision trees, and support vector machines.

- Unsupervised Learning: Unsupervised learning algorithms are trained on unlabeled data, where the algorithm must find patterns or relationships within the data. Clustering algorithms like K-means and dimensionality reduction techniques like PCA are examples of unsupervised learning algorithms.

Introduction to Neural Networks

Neural networks are a type of AI algorithm inspired by the structure and function of the human brain. They consist of interconnected nodes, or neurons, arranged in layers. A basic neural network consists of an input layer, one or more hidden layers, and an output layer. Training a neural network involves adjusting the weights of connections between neurons through a process called backpropagation.

Overview of Natural Language Processing (NLP)

Natural Language Processing (NLP) is a branch of AI that focuses on the interaction between computers and human language. NLP enables machines to understand, interpret, and generate human language. This technology is used in applications such as sentiment analysis, chatbots, language translation, and speech recognition.

Deep Dive into Reinforcement Learning

Reinforcement learning is a type of machine learning where an agent learns to make decisions by interacting with an environment. The agent receives feedback in the form of rewards or penalties based on its actions. Unlike supervised and unsupervised learning, reinforcement learning involves learning through trial and error. Applications of reinforcement learning include game playing, robotics, and autonomous vehicle control.

Understanding Convolutional Neural Networks (CNNs)

Convolutional Neural Networks (CNNs) are deep learning models designed for processing structured grid-like data, such as images. CNNs use convolutional layers to automatically extract features from input data and pooling layers to reduce the spatial dimensions of the data. They are widely used in image recognition tasks, object detection, and facial recognition. Examples of CNN architectures include AlexNet and ResNet.

Introduction to Generative Adversarial Networks (GANs)

Generative Adversarial Networks (GANs) are a class of AI algorithms that consist of two neural networks, a generator, and a discriminator, which are trained simultaneously. The generator creates synthetic data samples, while the discriminator distinguishes between real and fake data. GANs are used in applications like image generation, style transfer, and data augmentation.

Types of Home Equity Loans

When it comes to home equity loans, there are several types available to homeowners. These loans allow individuals to tap into the equity they have built in their homes over time, providing access to funds for various purposes.

Fixed-Rate vs. Variable-Rate Home Equity Loans

Fixed-rate home equity loans offer a set interest rate for the entire term of the loan, providing predictability in monthly payments. On the other hand, variable-rate home equity loans have interest rates that can fluctuate based on market conditions, potentially leading to changes in monthly payments.

- Fixed-Rate Home Equity Loans: Pros include stable monthly payments and protection against rising interest rates. Cons may include higher initial rates compared to variable-rate loans.

- Variable-Rate Home Equity Loans: Pros include lower initial rates and the potential for rates to decrease in the future. However, cons involve the risk of rising interest rates, leading to higher monthly payments.

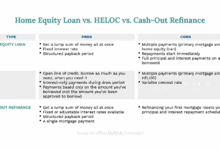

Eligibility Criteria Comparison: Traditional Home Equity Loan vs. HELOC

| Traditional Home Equity Loan | HELOC | |

|---|---|---|

| Minimum Equity Required | Higher equity required | Lower equity required |

| Access to Funds | Lump sum at once | Draw funds as needed |

| Interest Rates | Fixed | Variable |

Choosing a variable-rate home equity loan over a fixed-rate option exposes borrowers to the risk of increasing interest rates, potentially leading to higher monthly payments and overall costs.

Interest Rate Calculation

Interest rates for home equity loans are typically calculated based on the prime rate, with an added margin determined by the lender. For fixed-rate loans, this margin remains constant throughout the loan term, while for variable-rate loans, the margin can adjust periodically based on market conditions.

Benefits of Home Equity Loan Rates

When it comes to home equity loans, securing favorable rates can offer numerous benefits to homeowners. Lower interest rates can make borrowing more affordable and provide opportunities for financial flexibility.

Reduced Interest Costs

- By obtaining a home equity loan at a low rate, homeowners can significantly reduce the overall interest costs compared to other types of loans.

- Lower interest rates mean more of the monthly payments go towards paying off the principal balance, helping homeowners build equity faster.

Access to Larger Loan Amounts

- With favorable home equity loan rates, homeowners may qualify for larger loan amounts, allowing them to fund big expenses such as home renovations or debt consolidation.

- Higher loan amounts can provide financial flexibility and help homeowners achieve their goals without draining savings or retirement accounts.

Stability and Predictability

- Fixed-rate home equity loans offer stability and predictability in monthly payments, making it easier for homeowners to budget and plan for the future.

- Predictable payments can provide peace of mind, especially in times of economic uncertainty or fluctuating interest rates.

Risks Associated with Home Equity Loan Rates

When considering a home equity loan, it’s important to be aware of the potential risks that come with high rates. These risks can impact your financial stability and future planning, so understanding them is crucial.

Impact of Fluctuating Interest Rates

Fluctuating interest rates can have a significant impact on home equity loans. When rates increase, the amount you owe on your loan can also increase, leading to higher monthly payments. This can put a strain on your budget and potentially lead to financial difficulties if you are not prepared for the changes.

Financial Challenges with High Home Equity Loan Rates

High home equity loan rates can lead to various financial challenges. For example, if you are already struggling to make ends meet, a high-rate loan could exacerbate your financial situation. You may find yourself falling behind on payments, accumulating more debt, or even facing the risk of foreclosure if you are unable to keep up with the increased payments.

Example Scenario

For instance, let’s say you take out a home equity loan with a high interest rate to cover unexpected medical expenses. As the interest rates rise, your monthly payments also increase, making it difficult for you to meet your other financial obligations. This could lead to a cycle of debt and financial stress, impacting your overall financial well-being.

Factors Influencing Home Equity Loan Rates

When it comes to home equity loan rates, there are several key factors that lenders take into consideration when determining the interest rates offered to borrowers. Understanding these factors can help borrowers make informed decisions about their home equity loans.

Credit Score

One of the most important factors that lenders consider when setting home equity loan rates is the borrower’s credit score. A higher credit score indicates a lower credit risk for the lender, which can result in lower interest rates for the borrower. On the other hand, a lower credit score may lead to higher interest rates or even difficulty in securing a home equity loan.

Loan-to-Value Ratio

Another crucial factor that influences home equity loan rates is the loan-to-value (LTV) ratio. This ratio is calculated by dividing the amount of the loan by the appraised value of the property. A lower LTV ratio indicates less risk for the lender, potentially resulting in lower interest rates. Conversely, a higher LTV ratio may lead to higher interest rates or additional fees to offset the increased risk.

Market Conditions

Market conditions also play a significant role in determining home equity loan rates. Lenders take into account factors such as the current economic climate, interest rates set by the Federal Reserve, and overall demand for home equity loans. During times of economic uncertainty or high interest rates, lenders may adjust their rates accordingly to manage risk and maintain profitability.

Comparison of Home Equity Loan Rates to Other Loan Types

When comparing home equity loan rates to mortgage rates and personal loan rates, it is essential to understand the differences in interest rates, terms, and repayment options for each type of loan. Home equity loans, mortgage loans, and personal loans serve different purposes and have unique features that borrowers should consider before making a decision.

Interest Rates and Terms

- Home Equity Loan Rates: Typically have fixed interest rates and terms ranging from 5 to 30 years.

- Mortgage Rates: Can have fixed or adjustable rates with terms usually between 15 to 30 years.

- Personal Loan Rates: Often come with higher interest rates and shorter terms, typically ranging from 1 to 5 years.

Collateral Requirements and Risk Factors

- Home Equity Loan Rates: Require the borrower to use their home as collateral, posing the risk of foreclosure if unable to repay.

- Mortgage Rates: Also use the property as collateral but involve a larger loan amount and stricter eligibility criteria.

- Personal Loan Rates: Do not require collateral but may have higher interest rates due to the unsecured nature of the loan.

Impact on Credit Score and Financial Goals

- Home Equity Loan Rates: Can impact credit score positively or negatively, depending on timely payments and loan utilization.

- Mortgage Rates: Have a significant impact on credit score due to the high loan amount and long-term commitment.

- Personal Loan Rates: Impact credit score based on repayment history and utilization of the loan amount.

Beneficial Scenarios for Home Equity Loans

- When tax deductions on interest payments can offset the cost of borrowing.

- For large loan amounts needed for home renovations or debt consolidation.

- When long-term financial goals align with leveraging home equity for investment or major expenses.

Comparative Table Overview

| Loan Type | Average Rates | Average Loan Terms | Eligibility Criteria |

|---|---|---|---|

| Home Equity Loan | 3.5% – 7% | 5 – 30 years | Home equity, credit score, income verification |

| Mortgage Loan | 2.5% – 5% | 15 – 30 years | Credit score, income, property appraisal |

| Personal Loan | 6% – 15% | 1 – 5 years | Credit score, income verification |

Trends in Home Equity Loan Rates

Home equity loan rates have shown significant fluctuations over the past decade, influenced by various economic factors. Understanding these trends is crucial for homeowners considering taking out a home equity loan.

Historical Trends in Home Equity Loan Rates

Over the past decade, home equity loan rates have ranged from historic lows to higher levels due to economic conditions. For example, during the financial crisis of 2008, rates plummeted, creating opportunities for borrowers.

- 2010-2015: Home equity loan rates remained relatively low as the economy recovered from the recession.

- 2016-2018: Rates started to rise gradually in response to increasing interest rates set by the Federal Reserve.

- 2019-2020: Rates experienced fluctuations due to trade tensions and global economic uncertainties.

- 2021-2022: Rates dropped to record lows during the COVID-19 pandemic, offering favorable borrowing conditions for homeowners.

Influence of Economic Factors on Home Equity Loan Rates

Economic factors such as inflation, interest rates, and housing market conditions play a significant role in determining home equity loan rates. For instance, when inflation rises, lenders may increase rates to compensate for the decreased purchasing power of the dollar.

Economic stability and market demand can lead to lower rates, while uncertainty or inflationary pressures may result in higher rates.

Comparison with Mortgage Rates

Home equity loan rates are typically higher than mortgage rates due to the increased risk for lenders. Mortgages are secured by the home itself, making them less risky compared to home equity loans that are based on the homeowner’s equity.

Visual Representation of Trends

A line graph illustrating the changes in home equity loan rates over the years can provide a clear visual representation of the trends. This graph can help homeowners see the patterns and fluctuations in rates over time.

Impact of Government Policies

Government policies and regulatory changes can have a significant impact on home equity loan rates. For example, changes in tax laws or lending regulations can influence the cost of borrowing for homeowners.

By staying informed about government policies, homeowners can better understand how these changes may affect home equity loan rates and make informed decisions.

Strategies for Homeowners

Homeowners can take advantage of favorable home equity loan rates by monitoring market trends, improving their credit score, and comparing offers from different lenders. Refinancing or consolidating debt can also be viable strategies to leverage low rates effectively.

Understanding APR vs. Interest Rate in Home Equity Loans

When considering home equity loans, it’s crucial to understand the difference between the Annual Percentage Rate (APR) and the interest rate. While the interest rate represents the cost of borrowing the principal loan amount, the APR provides a more comprehensive view by factoring in additional fees and costs associated with the loan.

Components Included in APR vs. Interest Rate

- The interest rate is the percentage of the principal loan amount that the lender charges for borrowing, while the APR includes the interest rate plus any additional fees like origination fees, closing costs, and insurance premiums.

- Understanding the APR is essential as it gives borrowers a more accurate picture of the total cost of the loan over its term.

- Comparing APRs from different lenders allows borrowers to make an informed decision on which home equity loan offers the best overall value.

Importance of Comparing APRs

- By comparing APRs from various lenders, borrowers can determine the true cost of the loan and avoid any surprises in the form of hidden fees.

- Choosing a home equity loan with a lower APR can save borrowers money in the long run, making it a more cost-effective option.

Common Fees and Costs Included in the APR Calculation

| Fee/Cost | Description |

|---|---|

| Origination Fee | A fee charged by the lender for processing the loan application. |

| Closing Costs | Expenses incurred during the closing of the loan, including appraisal fees, title search, and attorney fees. |

| Insurance Premiums | Coverage costs for mortgage insurance or property insurance. |

How to Get the Best Home Equity Loan Rates

Securing the best home equity loan rates is crucial for borrowers looking to make the most of their investments. By following these tips, borrowers can increase their chances of qualifying for lower rates and saving money in the long run.

Improving Credit Scores for Better Rates

One of the most effective ways to secure favorable home equity loan rates is by improving your credit score. Lenders typically offer lower rates to borrowers with higher credit scores, as they are considered less risky. To boost your credit score, make sure to pay your bills on time, keep your credit card balances low, and avoid opening new credit accounts unnecessarily.

Negotiating with Lenders for Better Rates

Another strategy to obtain the best home equity loan rates is by negotiating with lenders. Be prepared to shop around and compare offers from different financial institutions. Once you have multiple quotes, use them as leverage to negotiate a better rate with your preferred lender. Remember, lenders are often willing to work with you to secure your business, so don’t hesitate to ask for a lower rate.

Impact of Federal Reserve Rates on Home Equity Loans

The Federal Reserve plays a crucial role in influencing the interest rates for various types of loans, including home equity loans. Changes in Federal Reserve rates can have a direct impact on the cost of borrowing through home equity loans, affecting both current and prospective borrowers.

Relationship between Federal Reserve Rates and Home Equity Loan Rates

The Federal Reserve’s monetary policy decisions, particularly changes in the federal funds rate, can lead to fluctuations in interest rates for home equity loans. When the Federal Reserve increases the federal funds rate, banks and financial institutions may raise the interest rates on home equity loans in response to the higher cost of borrowing money. Conversely, when the Federal Reserve lowers the federal funds rate, borrowers may see lower interest rates on home equity loans.

- Higher Federal Reserve rates can lead to increased interest rates on home equity loans, making borrowing more expensive for homeowners.

- Lower Federal Reserve rates can result in lower interest rates on home equity loans, potentially providing opportunities for homeowners to access more affordable financing.

Examples of Impact on Borrowers

For example, if the Federal Reserve raises interest rates by 0.25%, a homeowner with a variable-rate home equity loan may see their monthly payments increase, potentially impacting their overall financial situation.

Conversely, if the Federal Reserve cuts interest rates, a homeowner looking to tap into their home equity may find more favorable borrowing terms, saving money on interest payments over the life of the loan.

Home Equity Loan Rates Calculator

When it comes to understanding how home equity loan rates can impact your finances, using a home equity loan rates calculator can be extremely helpful. This tool allows borrowers to estimate their monthly payments based on different interest rates, loan amounts, and terms.

How a Home Equity Loan Rates Calculator Works

A home equity loan rates calculator typically requires input such as the loan amount, interest rate, loan term, and any additional fees. Once these details are entered, the calculator will generate an estimate of the monthly payments the borrower can expect to make.

Using a Calculator to Estimate Monthly Payments

- Input the loan amount you are considering

- Enter the interest rate offered by the lender

- Specify the loan term in years

- Include any additional fees or costs associated with the loan

Online Resources for Home Equity Loan Rates Calculators

There are several online resources where borrowers can access home equity loan rates calculators. Websites of financial institutions, mortgage lenders, and personal finance portals often offer these tools for free. Examples of such resources include Bankrate, NerdWallet, and LendingTree.

Home Equity Loan Rates and Tax Implications

When it comes to home equity loan rates, it’s essential to consider the tax implications for homeowners. Understanding how these rates impact tax deductions can help you make informed decisions about your finances.

Interest paid on home equity loans is often tax-deductible, making them a popular financing option for homeowners looking to tap into their home’s equity. By deducting the interest paid on these loans, you can potentially lower your taxable income and save money on your annual tax bill.

Tax Benefits of Deducting Interest Paid on Home Equity Loans

- Interest on home equity loans up to $100,000 is typically tax-deductible if the funds are used for home improvements or renovations.

- Homeowners can deduct the interest on both primary and secondary residences, as long as the loan meets certain criteria set by the IRS.

- By deducting interest payments, homeowners can potentially lower their effective interest rate, making home equity loans a cost-effective borrowing option.

Considerations When Evaluating Home Equity Loan Rates for Tax Purposes

- It’s crucial to determine how much of the interest paid on your home equity loan is tax-deductible based on the intended use of the funds.

- Consulting with a tax professional can help you better understand the specific tax implications of your home equity loan based on your individual financial situation.

- Keeping accurate records of your interest payments and the use of funds can simplify the tax filing process and ensure you maximize your potential deductions.

Current Market Overview of Home Equity Loan Rates

As of [current date], the home equity loan rates are influenced by various market conditions, impacting the rates offered by major lenders across the country.

Factors Affecting Home Equity Loan Rates

- The Federal Reserve’s interest rate decisions play a significant role in determining home equity loan rates. When the Fed raises or lowers interest rates, it can directly impact the rates offered to borrowers.

- Housing market trends also affect home equity loan rates. A strong housing market may lead to lower rates, while a declining market could result in higher rates.

- Credit scores are crucial in determining the interest rates available to borrowers. Those with higher credit scores are likely to secure lower rates, while lower scores may result in higher rates.

Comparison of Fixed-rate and Adjustable-rate Home Equity Loans

- Fixed-rate home equity loans provide stability with a consistent interest rate throughout the loan term, making budgeting easier for homeowners.

- Adjustable-rate home equity loans offer lower initial rates but come with the risk of rates increasing over time, potentially leading to higher payments in the future.

Advantages of Tapping into Home Equity

- Homeowners may benefit from tapping into their home equity through a loan to finance home improvements, consolidate debt, or cover major expenses.

- Using a home equity loan can provide access to funds at lower interest rates compared to other types of loans, making it a cost-effective borrowing option.

Forecasting Future Home Equity Loan Rates

Based on historical trends and current market conditions, it is anticipated that home equity loan rates may [increase/decrease/stabilize] in the near future. Borrowers should stay informed and monitor market changes to make informed decisions about their borrowing needs.

Case Studies on Home Equity Loan Rates

When it comes to home equity loan rates, real-life examples can provide valuable insights into how individuals have navigated the financial implications of their decisions. Let’s explore some case studies that shed light on the impact of different factors on home equity loan rates.

Impact of Credit History on Home Equity Loan Rates

Having a strong credit history can significantly influence the home equity loan rates offered to homeowners. For example, Sarah, with an excellent credit score, secured a low fixed-rate home equity loan at 3.5%, while John, with a poor credit history, had to settle for a variable rate of 7.5%.

Factors such as timely payments, low credit utilization, and a good credit mix played a crucial role in determining the interest rates in these case studies.

Negotiating Lower Home Equity Loan Rates

Some homeowners have successfully negotiated lower home equity loan rates with their lenders by showcasing their financial stability and ability to repay the loan. For instance, Mark managed to reduce his variable rate from 6% to 4.5% by demonstrating a consistent income and improved debt-to-income ratio.

Effective communication and a good relationship with the lender can lead to favorable outcomes in negotiating home equity loan rates.

Impact of Economic Conditions on Home Equity Loan Rates

Economic fluctuations can impact home equity loan rates, as seen in the case of Mary, who experienced a sudden increase in her variable rate from 5% to 8% due to rising interest rates in the market. This change significantly affected her monthly payments and overall financial planning.

Understanding the broader economic landscape can help homeowners anticipate and prepare for potential changes in home equity loan rates.

Refinancing Home Equity Loans at Different Rates

Refinancing home equity loans can have varying effects on homeowners’ financial well-being. For example, David refinanced his loan from a fixed rate of 4% to a variable rate of 3.5%, resulting in lower monthly payments initially. However, when interest rates rose, his payments increased, highlighting the importance of considering long-term implications when refinancing.

Careful evaluation of the terms and conditions of refinancing options is crucial to avoid unexpected financial challenges in the future.

Last Word

From the benefits and risks to comparisons with other loan types, this guide has covered all aspects of home equity loan rates. Make informed decisions and secure the best rates for your financial needs.