Consolidation Loans: Simplifying Your Debt Repayment

Consolidation loans offer a solution to streamline your debt repayment journey, making it easier to manage multiple debts. By delving into the intricacies of consolidation loans, we explore how this financial tool can benefit your overall financial health.

How Consolidation Loans Work

Consolidation loans are financial products that allow individuals to combine multiple debts into a single loan. This can simplify the repayment process by merging various monthly payments into one, often with a lower interest rate.

Types of Debts that can be Consolidated

- Credit card balances

- Personal loans

- Medical bills

- Student loans

- Other unsecured debts

Applying for a Consolidation Loan

To apply for a consolidation loan, individuals typically need to provide information about their outstanding debts, income, and credit score. Lenders will assess this information to determine the loan amount, interest rate, and repayment terms.

Benefits of Consolidating Debts

- Streamlined payments: Instead of managing multiple due dates and amounts, borrowers only need to make one payment each month.

- Lower interest rates: Consolidation loans often come with lower interest rates compared to credit cards or other high-interest debts.

- Potential savings: By reducing interest rates or extending the repayment period, borrowers may save money in the long run.

- Improved credit score: Making timely payments on a consolidation loan can positively impact a borrower’s credit score over time.

Pros and Cons of Consolidation Loans

Consolidation loans offer a number of benefits for individuals looking to simplify their debt management and potentially save money in the long run. However, there are also drawbacks and risks associated with these types of loans that should be carefully considered before making a decision.

Advantages of Consolidation Loans

- Streamlined debt management by combining multiple debts into a single monthly payment.

- Potential for lower interest rates compared to credit cards or other high-interest loans.

- Opportunity to extend the repayment period, reducing monthly payments.

- Possibility of improving credit score by making timely payments on a consolidated loan.

Drawbacks of Consolidation Loans

- Risk of accumulating more debt if spending habits are not addressed.

- May end up paying more interest over the long term with extended repayment periods.

- Some lenders may charge origination fees or prepayment penalties.

- Defaulting on a consolidation loan can have serious consequences on credit score.

Comparing Interest Rates

Consolidation loans typically offer lower interest rates compared to credit cards or payday loans, making them a more cost-effective option for debt consolidation.

Situations Where Consolidation Loans Are Beneficial

Consolidation loans are beneficial for individuals with multiple high-interest debts, such as credit card debt or personal loans, looking to simplify their payments and potentially save money on interest over time.

Eligibility Criteria Comparison

| Lender | Minimum Credit Score | Debt-to-Income Ratio |

|---|---|---|

| Lender A | 650 | Less than 50% |

| Lender B | 620 | Less than 45% |

Credit Score Impact

Your credit score plays a significant role in the approval process for consolidation loans. A higher credit score can help you qualify for lower interest rates and better loan terms.

“It’s important to address the root causes of debt and develop a solid financial plan to avoid falling back into debt after consolidating loans.” – Financial Expert

Types of Consolidation Loans

Consolidation loans come in various types to suit different financial needs and situations. Understanding the different types can help you choose the best option for your specific circumstances.

Step-by-Step Process of Applying for a Consolidation Loan

- Research and compare consolidation loan options from different financial institutions.

- Gather necessary documents such as proof of income, identification, and existing loan details.

- Submit your application along with the required documentation for review.

- If approved, review the terms and conditions of the consolidation loan carefully before accepting.

- Once accepted, use the funds to pay off existing debts and make timely payments on the consolidation loan.

Examples of Reputable Financial Institutions Offering Consolidation Loans

- Wells Fargo

- Chase Bank

- Discover Personal Loans

Consequences of Defaulting on a Consolidation Loan

Defaulting on a consolidation loan can lead to serious consequences such as damage to your credit score, collection efforts by the lender, and potential legal action to recover the outstanding debt.

Impact of Credit Score on the Approval of a Consolidation Loan

Your credit score plays a significant role in the approval process of a consolidation loan. A higher credit score increases your chances of approval and may result in better interest rates.

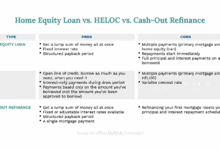

Comparison of Interest Rates of Different Consolidation Loans

- Fixed-Rate Consolidation Loan: Offers a stable interest rate throughout the loan term.

- Variable-Rate Consolidation Loan: Interest rate fluctuates based on market conditions.

- Home Equity Loan: Uses the equity in your home as collateral, typically resulting in lower interest rates.

List of Documents Required When Applying for a Consolidation Loan

- Proof of income (pay stubs, tax returns)

- Identification (driver’s license, passport)

- Details of existing loans and debts

- Bank statements

Factors to Consider Before Getting a Consolidation Loan

When considering a consolidation loan, there are several important factors to evaluate to ensure that it is the right financial decision for your situation. Factors such as credit score, credit history, interest rates, and choosing the right lender play a significant role in the success of a consolidation loan.

Credit Score and Credit History Impact

Your credit score and credit history are crucial factors that lenders consider when determining your eligibility for a consolidation loan. A higher credit score and a positive credit history can increase your chances of qualifying for a consolidation loan with favorable terms. On the other hand, a lower credit score or negative credit history may result in higher interest rates or difficulty in obtaining a consolidation loan.

Role of Interest Rates

Interest rates play a key role in determining the overall cost of a consolidation loan. Lower interest rates can lead to lower monthly payments and less interest paid over the life of the loan. It is essential to compare interest rates from different lenders to find the most competitive offer that aligns with your financial goals.

Choosing the Right Lender

When selecting a lender for a consolidation loan, it is important to research and compare various options to find a reputable lender with favorable terms. Consider factors such as interest rates, loan terms, customer reviews, and customer service. Choosing the right lender can make a significant difference in the overall success and satisfaction of your consolidation loan experience.

Debt Consolidation vs. Debt Settlement

When facing a financial crisis, individuals often consider options like debt consolidation and debt settlement to manage their debts effectively. It is crucial to understand the key differences between these two debt relief methods to make an informed decision that aligns with your financial goals.

Key Differences Between Debt Consolidation and Debt Settlement

- Debt Consolidation:

- Process: Combines multiple debts into a single loan with a lower interest rate.

- Eligibility Requirements: Generally requires a good credit score and steady income.

- Effects on Credit Scores: Initially may have a minor impact on credit scores, but can improve over time with timely payments.

- Long-Term Financial Implications: Helps individuals pay off debts faster and save money on interest in the long run.

- Debt Settlement:

- Process: Negotiates with creditors to reduce the total amount owed, typically resulting in a lump-sum payment.

- Eligibility Requirements: Usually requires individuals to be significantly behind on payments and have a financial hardship.

- Effects on Credit Scores: Can have a significant negative impact on credit scores, as accounts are usually settled for less than the full amount owed.

- Long-Term Financial Implications: May result in taxable income on the forgiven debt and potential legal actions from creditors.

It’s important to carefully weigh the pros and cons of debt consolidation and debt settlement to determine the best approach for your financial situation.

Choosing Between Debt Consolidation and Debt Settlement

If you have a stable income and good credit score, debt consolidation may be a suitable option to streamline your payments and save on interest. On the other hand, if you are facing financial hardship and falling behind on payments, debt settlement could provide a way to reduce your total debt amount, although at the cost of a lower credit score and potential tax implications.

Real-Life Example: Sarah opted for debt consolidation as she had a steady job and wanted to simplify her debt payments, ultimately saving money on interest payments and improving her credit score over time.

Common Misconceptions about Consolidation Loans

Consolidation loans are often misunderstood, leading to various misconceptions about how they work and their benefits. Let’s debunk some of the common myths surrounding consolidation loans and provide factual information to clarify any confusion.

Consolidation Loans are the Same as Debt Management or Credit Counseling

Many people mistakenly believe that consolidation loans are the same as debt management or credit counseling. While all three options aim to help individuals manage their debts, they operate differently. Consolidation loans involve taking out a new loan to pay off existing debts, combining them into a single monthly payment with a potentially lower interest rate. Debt management and credit counseling, on the other hand, involve working with a credit counseling agency to negotiate with creditors for lower interest rates or payment plans.

Consolidation Loans Lead to Increased Debt

Another common misconception is that consolidation loans lead to increased debt. In reality, consolidation loans can actually help individuals pay off their debts more efficiently by streamlining multiple payments into one. By making timely payments on the consolidation loan, individuals can reduce their overall debt faster than if they were making separate payments on multiple debts.

Consolidation Loans Are Only for Those with Good Credit

Some people believe that consolidation loans are only available to those with good credit. While having good credit can certainly help secure a consolidation loan with a lower interest rate, there are options available for individuals with less-than-perfect credit. Lenders may offer secured consolidation loans or options that consider other factors beyond just credit score.

Consolidation Loans Are a Quick Fix for Financial Problems

It is a common misconception that consolidation loans are a quick fix for financial problems. While consolidation loans can provide relief by simplifying debt payments, they are not a cure-all solution. It is important for individuals to address the root causes of their debt and make necessary changes to their spending habits to avoid falling back into debt after consolidating.

Consolidation Loan Alternatives

When considering alternatives to consolidation loans, it’s essential to explore various debt management strategies that may better suit your financial situation. Below are some options to consider:

Debt Repayment Plans

Debt repayment plans involve working with a credit counseling agency to create a structured repayment schedule with your creditors. These plans typically aim to lower interest rates and consolidate payments into one monthly amount. While this option may not reduce your overall debt, it can provide a more manageable way to pay off what you owe.

Balance Transfer Credit Cards

Balance transfer credit cards allow you to consolidate multiple high-interest credit card balances onto one card with a lower or 0% introductory interest rate. This can help you save money on interest charges and pay off your debt faster. However, be mindful of transfer fees and the risk of accumulating more debt if not used responsibly.

Debt Snowball or Avalanche Method

The debt snowball method involves paying off your smallest debts first, while the debt avalanche method focuses on tackling high-interest debts first. Both approaches aim to build momentum and motivation as you clear debts one by one. Consider these methods if you prefer a more hands-on approach to debt repayment.

Debt Settlement

Debt settlement involves negotiating with creditors to settle your debt for less than what you owe. While this can result in a lower overall debt amount, it may negatively impact your credit score and require a lump sum payment. It’s crucial to weigh the pros and cons before pursuing this option.

Personal Loans

Personal loans can be used to consolidate debt, especially if you have a good credit score. These loans typically have fixed interest rates and terms, making it easier to budget for repayments. However, be cautious of high interest rates for those with less-than-perfect credit.

Consider these alternatives to consolidation loans based on your financial goals, credit history, and overall debt situation.

Impact of Consolidation Loans on Credit Scores

Taking a consolidation loan can have both positive and negative effects on one’s credit score. While it can help simplify debt repayment and improve credit utilization, it can also temporarily lower your credit score due to the hard inquiry and new credit account opening.

Strategies to Minimize Credit Score Impact

- Avoid opening new credit accounts during the consolidation process to prevent further credit score decrease.

- Make timely payments on your consolidation loan to show responsible financial behavior.

- Monitor your credit report regularly to catch any errors that could negatively impact your score.

Examples of Improving Credit Scores with Timely Repayment

- By consistently making on-time payments on your consolidation loan, you can show creditors that you are a reliable borrower, leading to a gradual increase in your credit score over time.

- Reducing your overall debt through consolidation can also positively impact your credit utilization ratio, further boosting your credit score.

Long-Term Effects on Creditworthiness

Consistently managing your consolidation loan and other debts responsibly can lead to long-term improvement in your creditworthiness. Over time, as you pay off your consolidation loan and reduce your debt burden, your credit score is likely to increase, making you more attractive to lenders.

Credit Score Ranges Comparison

| Before Consolidation Loan | After Consolidation Loan |

|---|---|

| Fair (580-669) | Good (670-739) |

| Good (670-739) | Very Good (740-799) |

| Very Good (740-799) | Excellent (800-850) |

Difference Between Consolidation Loans and other Loans

Consolidation loans typically have a temporary negative impact on credit scores due to the new credit account opening and hard inquiry. However, if managed well, they can lead to an overall improvement in credit scores by reducing debt and demonstrating responsible repayment behavior.

Monitoring Credit Scores Guide

- Check your credit score regularly through free credit monitoring services or platforms provided by credit bureaus.

- Review your credit report for any errors or discrepancies that could affect your credit score negatively.

- Set up alerts for any significant changes in your credit score to stay informed about your financial health.

Importance of Maintaining a Good Credit Score

Maintaining a good credit score is crucial while managing consolidation loans as it affects your ability to access future credit at favorable terms. A good credit score can help you qualify for lower interest rates, higher credit limits, and better financial opportunities in the long run.

Consolidation Loan Repayment Strategies

When it comes to managing a consolidation loan, having a solid repayment strategy in place is crucial. By making informed decisions and taking proactive steps, borrowers can effectively pay off their debts and improve their financial situation.

Benefits of Making Extra Payments

- Reduced Interest Costs: Making extra payments towards a consolidation loan can help lower the total interest paid over the life of the loan.

- Accelerated Debt Repayment: By paying more than the minimum amount due, borrowers can shorten the repayment period and become debt-free sooner.

- Improved Credit Score: Timely and additional payments can positively impact credit scores by demonstrating responsible financial behavior.

Budgeting and Financial Planning

- Track Expenses: Creating a detailed budget can help identify areas where expenses can be reduced to allocate more funds towards loan repayment.

- Set Financial Goals: Establishing clear financial goals and priorities can guide borrowers in managing their finances effectively.

- Emergency Fund: Building an emergency fund can prevent unexpected expenses from derailing loan repayment efforts.

Avoiding Default or Late Payments

- Set up Automatic Payments: Automating loan payments can help ensure timely payments and avoid late fees.

- Communicate with Lenders: In case of financial difficulties, borrowers should communicate with lenders to explore alternative repayment options.

- Seek Financial Counseling: Consulting a financial advisor can provide guidance on managing debt and avoiding default.

Creating a Personalized Repayment Plan

Assess your current financial situation, set repayment goals, explore repayment options, and create a detailed plan outlining monthly payments and milestones.

Loan Forgiveness Programs

- Public Service Loan Forgiveness: Eligible borrowers working in public service sectors may qualify for loan forgiveness after meeting specific criteria.

- Income-Driven Repayment Plans: These plans adjust monthly payments based on income levels, offering loan forgiveness after a certain period.

Negotiating Lower Interest Rates or Refinancing

- Shop Around for Rates: Comparing offers from different lenders can help secure lower interest rates for refinancing consolidation loans.

- Consider Loan Terms: Extending the repayment term through refinancing may reduce monthly payments but increase total interest costs.

Income-Driven Repayment Plans vs. Standard Repayment Plans

- Income-Driven Plans: Offer lower monthly payments based on income but may result in higher total interest costs over the repayment period.

- Standard Repayment Plans: Fixed monthly payments can help pay off the loan faster but may be challenging for borrowers with limited income.

Sample Repayment Schedule with Early Payments

By making early payments or additional contributions towards the principal amount, borrowers can save on interest costs and shorten the overall repayment period. Here is a sample repayment schedule illustrating the impact of early payments on interest savings.

Risks of Defaulting on a Consolidation Loan

Defaulting on a consolidation loan can have severe consequences, impacting both your credit score and overall financial well-being. Here’s what you need to know about the risks associated with defaulting on a consolidation loan.

Credit Score Damage and Legal Actions

Defaulting on a consolidation loan can significantly damage your credit score, making it harder to secure loans or credit in the future. In addition, lenders may take legal action against you to recover the unpaid debt, leading to potential lawsuits and court judgments.

Financial Impact in Terms of Increased Interest Rates and Fees

When you default on a consolidation loan, you may face increased interest rates and additional fees, exacerbating your financial burden. This can lead to a cycle of debt that is challenging to break free from, causing further financial strain.

Guidance for Struggling Borrowers

If you are struggling to make payments on your consolidation loan, it’s crucial to contact your lender immediately. Discussing alternative payment plans or seeking financial assistance can help you avoid defaulting and mitigate the associated risks.

Real-Life Stories of Financial Hardship

There are numerous real-life stories of individuals who faced financial hardship due to defaulting on a consolidation loan. These stories highlight the long-term consequences on financial stability and creditworthiness, serving as cautionary tales for borrowers.

Comparison Table of Consequences

| Defaulting on Consolidation Loan | Staying Current on Payments |

|---|---|

| Damage to credit score | Maintain or improve credit score |

| Potential legal actions | Avoid legal consequences |

| Increased interest rates and fees | Stable interest rates and fees |

Consolidation Loans for Specific Financial Situations

Consolidation loans can be a valuable tool for individuals facing different financial challenges. Whether someone is struggling with multiple high-interest debts or trying to streamline their payments, consolidation loans offer a way to simplify finances and potentially save money in the long run.

Consolidation Loans for Credit Card Debt

- Consolidation loans can help individuals with high credit card debt by combining multiple balances into one manageable payment.

- By securing a lower interest rate through a consolidation loan, borrowers can save money on interest and pay off their debt faster.

- Example: Sarah had accumulated credit card debt from multiple cards with high interest rates. By taking out a consolidation loan, she was able to lower her interest rate and pay off her debt more efficiently.

Consolidation Loans for Student Loans

- For those burdened with student loan debt, consolidation loans can simplify repayment by combining multiple loans into a single monthly payment.

- Consolidation loans for student loans may also offer lower interest rates, extended repayment terms, or the option to switch from variable to fixed interest rates.

- Example: John had several student loans with varying interest rates and monthly payments. By consolidating his loans, he was able to set up a more manageable repayment plan and save money on interest.

Consolidation Loans for Medical Bills

- Individuals struggling with overwhelming medical bills can benefit from consolidation loans by consolidating their medical debt into one affordable payment.

- Consolidation loans can provide a structured repayment plan and potentially lower interest rates, making it easier to manage medical expenses.

- Example: Emily faced a mountain of medical bills after a serious illness. By using a consolidation loan, she was able to consolidate her medical debt and make steady progress towards paying it off.

Consolidation Loans for Personal Loans

- Those with multiple personal loans can use consolidation loans to combine their debts into one convenient payment, simplifying their financial obligations.

- By securing a lower interest rate through consolidation, individuals can reduce the total amount paid over time and pay off their loans more efficiently.

- Example: Mark had taken out several personal loans for various expenses. Through a consolidation loan, he was able to streamline his payments and save money on interest.

How to Avoid Pitfalls When Considering a Consolidation Loan

Consolidation loans can be a helpful tool for managing debt, but there are pitfalls to watch out for. It’s important to be aware of these potential pitfalls and take steps to avoid them to ensure that a consolidation loan works in your favor.

Factors to Consider Before Taking Out a Consolidation Loan

- Assess your total debt: Before applying for a consolidation loan, calculate the total amount of debt you have. Make sure the loan amount will be sufficient to cover all your debts.

- Interest rates: Compare the interest rates of your current debts with the rate offered on the consolidation loan. Ensure that you will be saving money in the long run by consolidating.

- Loan terms: Understand the terms and conditions of the consolidation loan, including any fees, penalties, or prepayment clauses. Make sure you are comfortable with the repayment schedule.

Tips for Assessing Your Financial Situation

- Create a budget: Evaluate your income and expenses to determine how much you can afford to pay towards a consolidation loan each month.

- Review your credit report: Check your credit report for any errors or discrepancies that may affect your ability to qualify for a consolidation loan or impact the interest rate you receive.

- Seek financial advice: Consider consulting with a financial advisor to get personalized guidance on whether a consolidation loan is the right choice for your situation.

Importance of Reading Loan Terms and Conditions

It is crucial to carefully review the terms and conditions of a consolidation loan agreement before signing. Pay close attention to the interest rate, repayment schedule, fees, and any penalties for late payments or early repayment. Understanding these terms will help you avoid surprises and ensure that you can meet your obligations.

Consolidation Loans and Financial Stability

Consolidation loans can be a valuable tool for individuals looking to achieve financial stability by managing their debt more effectively. By combining multiple debts into a single loan with one monthly payment, individuals can simplify their finances and potentially lower their overall interest rates. However, it’s essential to understand the different types of consolidation loans available, how to apply for one, the impact of interest rates, potential risks, and how consolidation loans compare to other debt management options.

Types of Consolidation Loans

- Personal Loan: A traditional unsecured loan used to pay off various debts.

- Home Equity Loan: Secured by the borrower’s home equity, offering lower interest rates but risking property as collateral.

- Balance Transfer Credit Card: Transferring high-interest credit card debt to a card with a lower introductory rate for a limited time.

Applying for a Consolidation Loan

- Check your credit score and gather necessary financial documents.

- Shop around for lenders offering competitive rates and terms.

- Submit your application with accurate information and wait for approval.

- If approved, review the terms carefully before accepting the loan offer.

Impact of Interest Rates

Higher interest rates can diminish the benefits of consolidation loans by increasing the overall cost of the debt.

- Lower interest rates can lead to reduced monthly payments and potentially save money in the long run.

- Variable interest rates may fluctuate, affecting the total amount paid over time.

Risks of Consolidation Loans

Consolidation loans may create a false sense of financial security, leading individuals to accumulate more debt.

- Defaulting on a consolidation loan can result in serious consequences, including damage to credit scores and potential legal actions.

- Continued overspending or lack of financial discipline can worsen the debt situation despite consolidation.

Pros and Cons Comparison

| Consolidation Loans | Other Debt Management Options |

|---|---|

| Streamlined debt repayment | May offer debt forgiveness or settlement |

| Potential for lower interest rates | Can have less impact on credit scores |

| Risks of accumulating more debt | May require professional assistance |

Consolidation Loans in the Current Economic Landscape

In today’s ever-changing economic landscape, the availability and terms of consolidation loans are significantly impacted by various economic factors. Understanding these influences can help individuals make informed decisions when considering consolidation options.

Impact of Economic Factors on Consolidation Loans

- The interest rates set by central banks play a crucial role in determining the cost of borrowing for financial institutions. When these rates fluctuate, it can directly affect the interest rates offered on consolidation loans.

- Economic stability and growth also impact the availability of consolidation loans. During economic downturns, lenders may tighten their lending criteria, making it more challenging for individuals to qualify for consolidation loans.

- Inflation rates can affect the overall cost-effectiveness of consolidation loans. High inflation can erode the value of money over time, potentially increasing the burden of repayment for borrowers.

Trends in the Consolidation Loan Market

- During periods of economic uncertainty, such as recessions or financial crises, the demand for consolidation loans may increase as individuals seek ways to manage their debts more effectively.

- Lenders may adjust their offerings in response to economic changes, introducing new products or modifying existing ones to meet the evolving needs of borrowers.

Navigating Consolidation Loans in a Fluctuating Economic Environment

- Monitor interest rate trends and economic indicators to assess the optimal timing for consolidating debts. Choosing the right time could result in more favorable terms and lower overall costs.

- Consider consulting with financial advisors or experts to gain insights into the current economic landscape and its potential impact on consolidation loans.

- Stay informed about changes in lending practices and regulations to ensure compliance and maximize the benefits of consolidation loans.

Final Thoughts

As we conclude our discussion on consolidation loans, it becomes evident that this financial strategy can provide individuals with a structured approach to debt management, paving the way for a more secure financial future.